Question: Please share the solution on excel. You have an opportunity to acquire a property from First Capital Bank. The bank recently obtained the property from

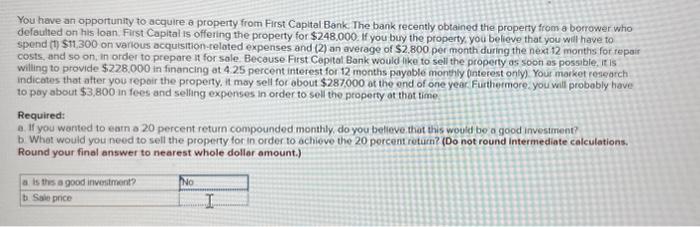

You have an opportunity to acquire a property from First Capital Bank. The bank recently obtained the property from a borrower whio defauhed on his loan. First Capital is offering the property for $248.000. If you buy the property, you believe that you will have to spend (t) $11,300 on various acquisition-related expenses and (2) an average of $2.800 per month during the next 12 months for tepair costs, and so on, in order to prepare it for sole. Because. First Cepital Bank would ike to sell the property as soon as possible, ir is willing to provide $228,000 in financing at 4.25 percent interest for 12 months payoble monthly (interest only). Your market research indicates that after you repair the property. it may sell for about $287,000 at the ond of one year Furthermore you will probably have to pay about $3,800 in fees and selling expenses in order to sell the property at that time Required: a. If you warted to eam o 20 percent return compounded monthly, do you believe that this would bo a good invesiment? b. What would you need to sell the property tor in order to achieve the 20 porcent return? (Do not round intermediate calculations. Round your final answer to nearest whole dollor amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts