Question: Please share your experience, it this is long question, just please explain the step, I will do by myself, just provide guide line. I will

Please share your experience, it this is long question, just please explain the step, I will do by myself, just provide guide line.

Please share your experience, it this is long question, just please explain the step, I will do by myself, just provide guide line.

I will upvote you

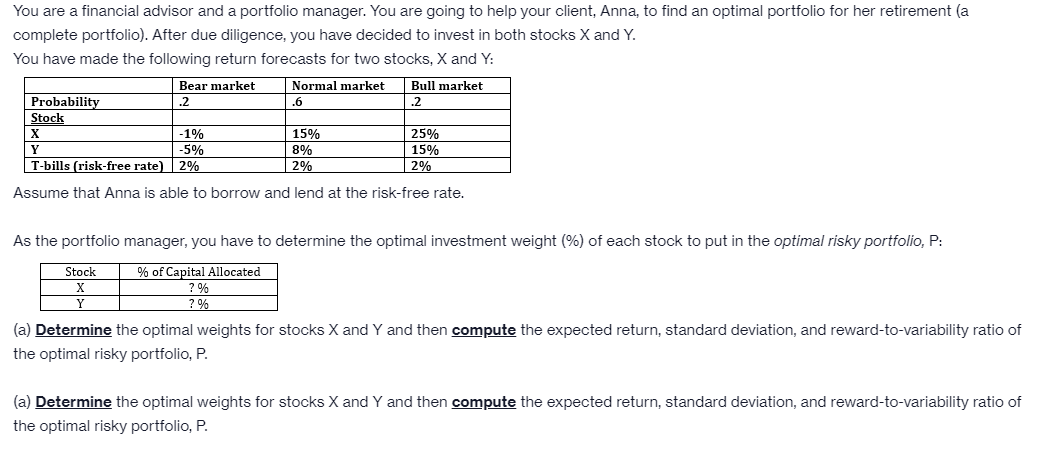

You are a financial advisor and a portfolio manager. You are going to help your client, Anna, to find an optimal portfolio for her retirement (a complete portfolio). After due diligence, you have decided to invest in both stocks X and Y. You have made the following return forecasts for two stocks, X and Y: Bear market Normal market Bull market Probability .2 .6 .2 Stock X - 1% 15% 25% Y -5% 8% 15% T-bills (risk-free rate) 2% 2% 2% Assume that Anna is able to borrow and lend at the risk-free rate. As the portfolio manager, you have to determine the optimal investment weight (%) of each stock to put in the optimal risky portfolio, P: Stock % of Capital Allocated ? % ? % Y (a) Determine the optimal weights for stocks X and Y and then compute the expected return, standard deviation, and reward-to-variability ratio of the optimal risky portfolio, P. (a) Determine the optimal weights for stocks X and Y and then compute the expected return, standard deviation, and reward-to-variability ratio of the optimal risky portfolio, P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts