Question: Please show a complete step-by-step solution thank you! 1.) 2.) Adjusting Balance Sheet and Income Statement for LIFO to FIFO In its December 2019 10-K,

Please show a complete step-by-step solution thank you!

1.)

2.)

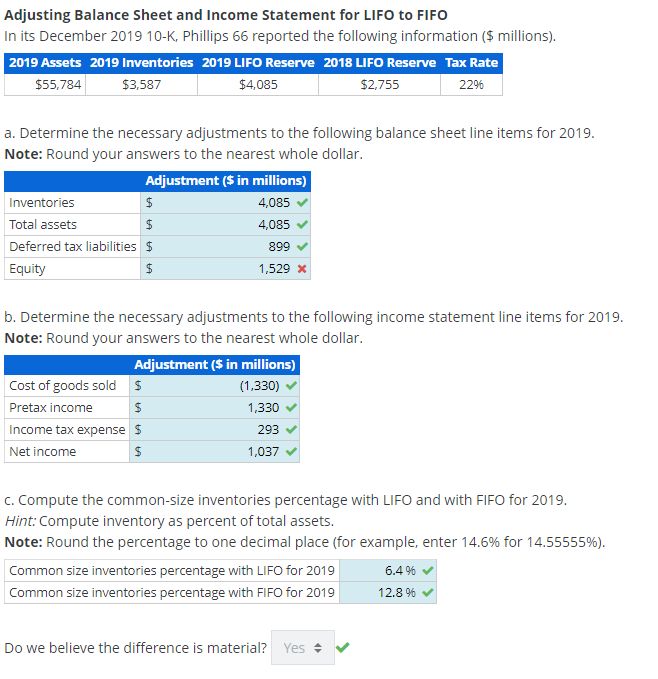

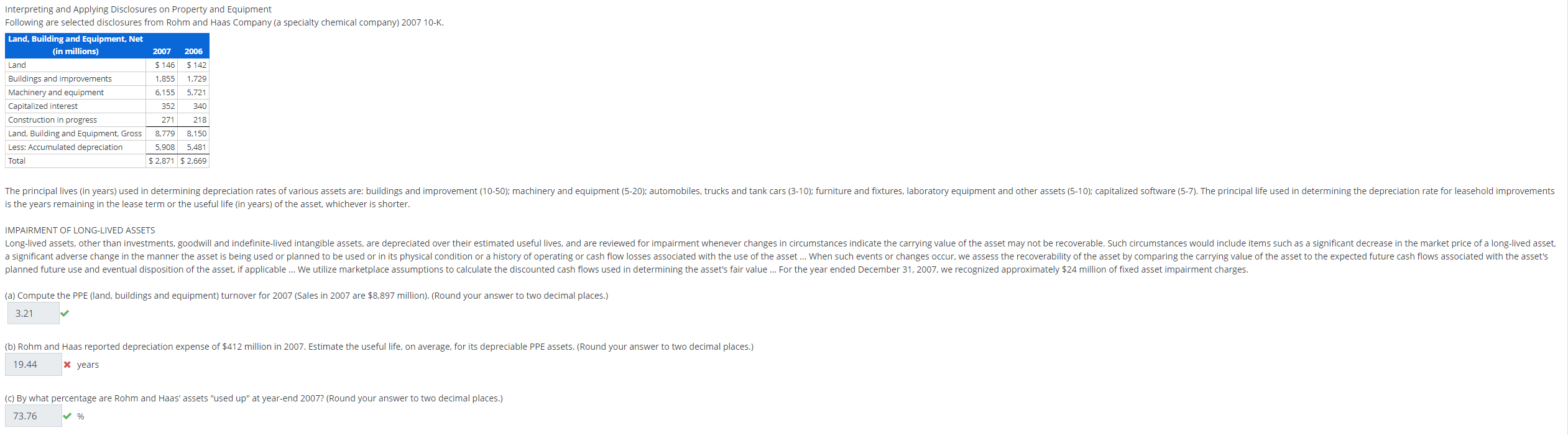

Adjusting Balance Sheet and Income Statement for LIFO to FIFO In its December 2019 10-K, Phillips 66 reported the following information (\$ millions). a. Determine the necessary adjustments to the following balance sheet line items for 2019 . Note: Round your answers to the nearest whole dollar. b. Determine the necessary adjustments to the following income statement line items for 2019. Note: Round your answers to the nearest whole dollar. c. Compute the common-size inventories percentage with LIFO and with FIFO for 2019. Hint: Compute inventory as percent of total assets. Note: Round the percentage to one decimal place (for example, enter 14.6% for 14.55555% ). Do we believe the difference is material? Interpreting and Applying Disclosures on Property and Equipment Following are selected disclosures from Rohm and Haas Company (a specialty chemical company) 2007 10-K. The principal lives (in years) used in determining depreciation rates of various assets are: buildings an is the years remaining in the lease term or the useful life (in years) of the asset, whichever is shorter. IMPAIRMENT OF ONG (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8.897 million) (Round your answer to two decimal places) x years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts