Question: Please show a complete step-by-step solution thank you! Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its

Please show a complete step-by-step solution thank you!

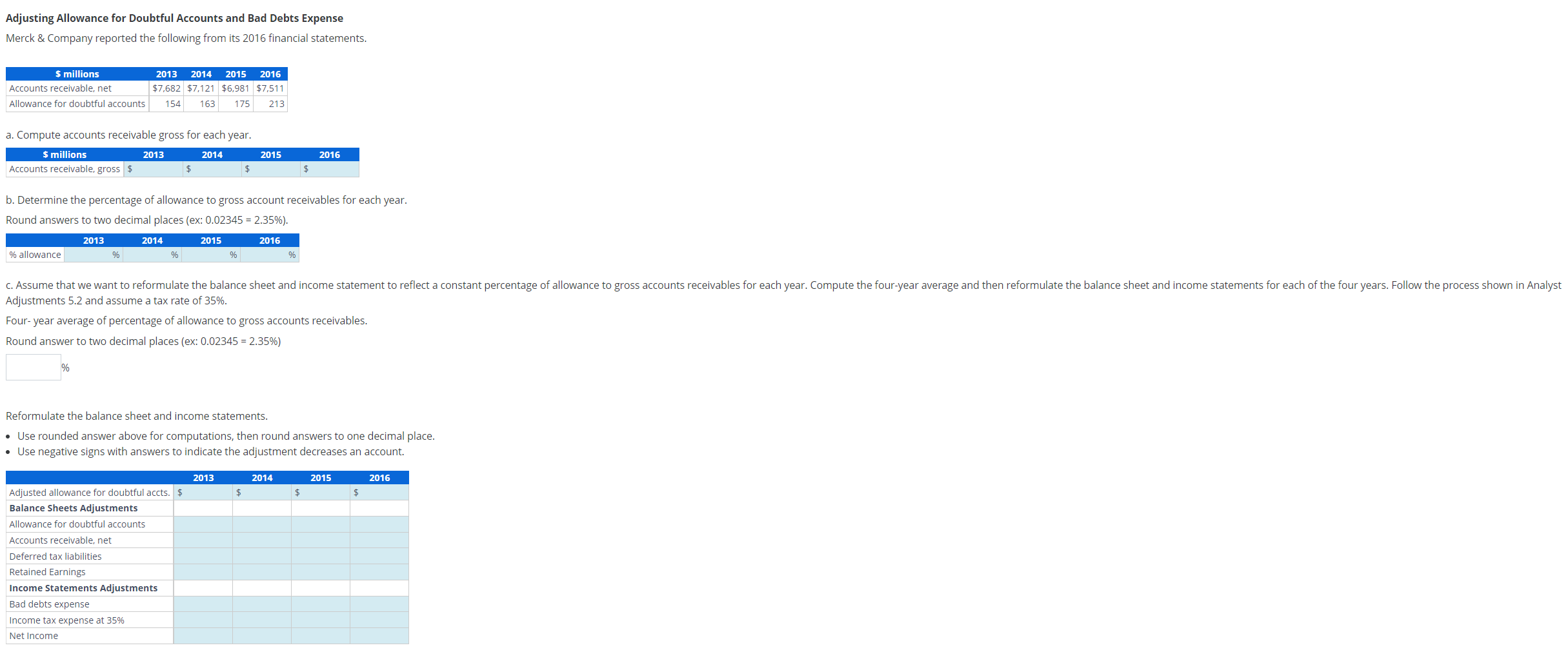

Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck \& Company reported the following from its 2016 financial statements. a. Compute accounts receivable gross for each year. \$ millions 2013 2014 2015 2016 b. Determine the percentage of allowance to gross account receivables for each year. Round answers to two decimal places (ex: 0.02345=2.35% ). Adjustments 5.2 and assume a tax rate of 35%. Four- year average of percentage of allowance to gross accounts receivables. Round answer to two decimal places (ex: 0.02345=2.35% ) Reformulate the balance sheet and income statements. - Use rounded answer above for computations, then round answers to one decimal place. - Use negative signs with answers to indicate the adjustment decreases an account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts