Question: PLEASE SHOW ALL CALCULATION & FORMULAS IF ANY. YOU CAN USE EXCEL. I WILL GIVE IT A THUMBS UP. THANK YOU! Module 6 Individual Assignment

PLEASE SHOW ALL CALCULATION & FORMULAS IF ANY. YOU CAN USE EXCEL. I WILL GIVE IT A THUMBS UP. THANK YOU!

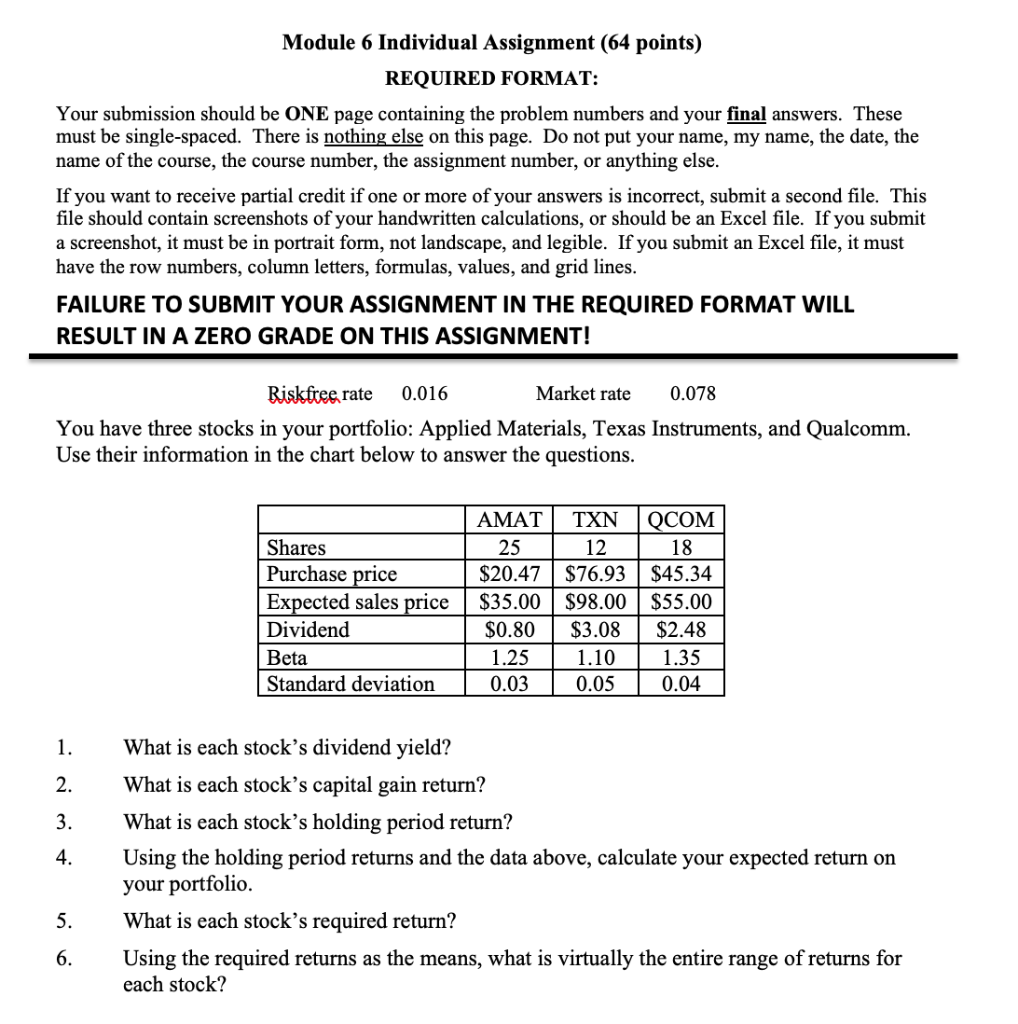

Module 6 Individual Assignment (64 points) REQUIRED FORMAT: Your submission should be ONE page containing the problem numbers and your final answers. These must be single-spaced. There is nothing else on this page. Do not put your name, my name, the date, the name of the course, the course number, the assignment number, or anything else. If you want to receive partial credit if one or more of your answers is incorrect, submit a second file. This file should contain screenshots of your handwritten calculations, or should be an Excel file. If you submit a screenshot, it must be in portrait form, not landscape, and legible. If you submit an Excel file, it must have the row numbers, column letters, formulas, values, and grid lines. FAILURE TO SUBMIT YOUR ASSIGNMENT IN THE REQUIRED FORMAT WILL RESULT IN A ZERO GRADE ON THIS ASSIGNMENT! Riskfree rate 0.016 Market rate 0.078 You have three stocks in your portfolio: Applied Materials, Texas Instruments, and Qualcomm. Use their information in the chart below to answer the questions. Shares Purchase price Expected sales price Dividend Beta Standard deviation AMAT TXN 25 12 $20.47 $76.93 $35.00 $98.00 $0.80 $3.08 1.25 1.10 0.03 0.05 QCOM 18 $45.34 $55.00 $2.48 1.35 0.04 1. 2. 3. 4. What is each stocks dividend yield? What is each stock's capital gain return? What is each stocks holding period return? Using the holding period returns and the data above, calculate your expected return on your portfolio What is each stock's required return? Using the required returns as the means, what is virtually the entire range of returns for each stock? 5. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts