Question: (PLEASE SHOW ALL CALCULATION, NO EXCEL FUNCTIONS) Four years from today there is a $17,500,000 cash flow that needs to be immunized today. There are

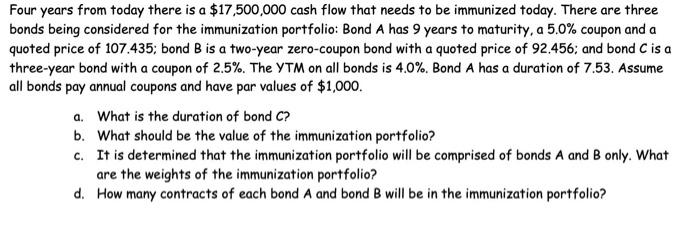

Four years from today there is a $17,500,000 cash flow that needs to be immunized today. There are three bonds being considered for the immunization portfolio: Bond A has 9 years to maturity, a 5.0% coupon and a quoted price of 107.435; bond B is a two-year zero-coupon bond with a quoted price of 92.456; and bond C is a three-year bond with a coupon of 2.5%. The YTM on all bonds is 4.0%. Bond A has a duration of 7.53. Assume all bonds pay annual coupons and have par values of $1,000. a. What is the duration of bond C ? b. What should be the value of the immunization portfolio? c. It is determined that the immunization portfolio will be comprised of bonds A and B only. What are the weights of the immunization portfolio? d. How many contracts of each bond A and bond B will be in the immunization portfolio? Four years from today there is a $17,500,000 cash flow that needs to be immunized today. There are three bonds being considered for the immunization portfolio: Bond A has 9 years to maturity, a 5.0% coupon and a quoted price of 107.435; bond B is a two-year zero-coupon bond with a quoted price of 92.456; and bond C is a three-year bond with a coupon of 2.5%. The YTM on all bonds is 4.0%. Bond A has a duration of 7.53. Assume all bonds pay annual coupons and have par values of $1,000. a. What is the duration of bond C ? b. What should be the value of the immunization portfolio? c. It is determined that the immunization portfolio will be comprised of bonds A and B only. What are the weights of the immunization portfolio? d. How many contracts of each bond A and bond B will be in the immunization portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts