Question: (PLEASE SHOW ALL CALCULATION, NO EXCEL FUNCTIONS) KCB, Corp. wants to set up a hedge on its expected February purchase of 800,000 barrels of crude

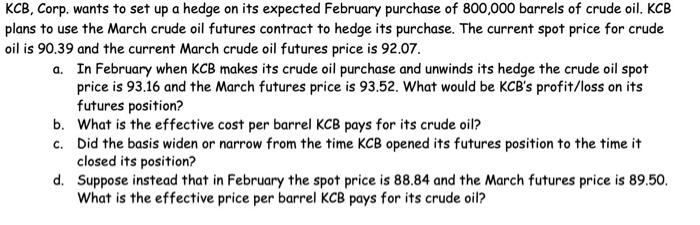

KCB, Corp. wants to set up a hedge on its expected February purchase of 800,000 barrels of crude oil. KCB plans to use the March crude oil futures contract to hedge its purchase. The current spot price for crude oil is 90.39 and the current March crude oil futures price is 92.07. a. In February when KCB makes its crude oil purchase and unwinds its hedge the crude oil spot price is 93.16 and the March futures price is 93.52. What would be KCB's profit/loss on its futures position? b. What is the effective cost per barrel KCB pays for its crude oil? c. Did the basis widen or narrow from the time KCB opened its futures position to the time it closed its position? d. Suppose instead that in February the spot price is 88.84 and the March futures price is 89.50. What is the effective price per barrel KCB pays for its crude oil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts