Question: PLEASE SHOW ALL CALCULATIONS AND DON'T COPY A PREVIOUS ANSWER FOR THIS QUESTION. A18-17 Sale and Leaseback: Central Purchasing Ltd. (CPL) owns the building it

PLEASE SHOW ALL CALCULATIONS AND DON'T COPY A PREVIOUS ANSWER FOR THIS QUESTION.

PLEASE SHOW ALL CALCULATIONS AND DON'T COPY A PREVIOUS ANSWER FOR THIS QUESTION.

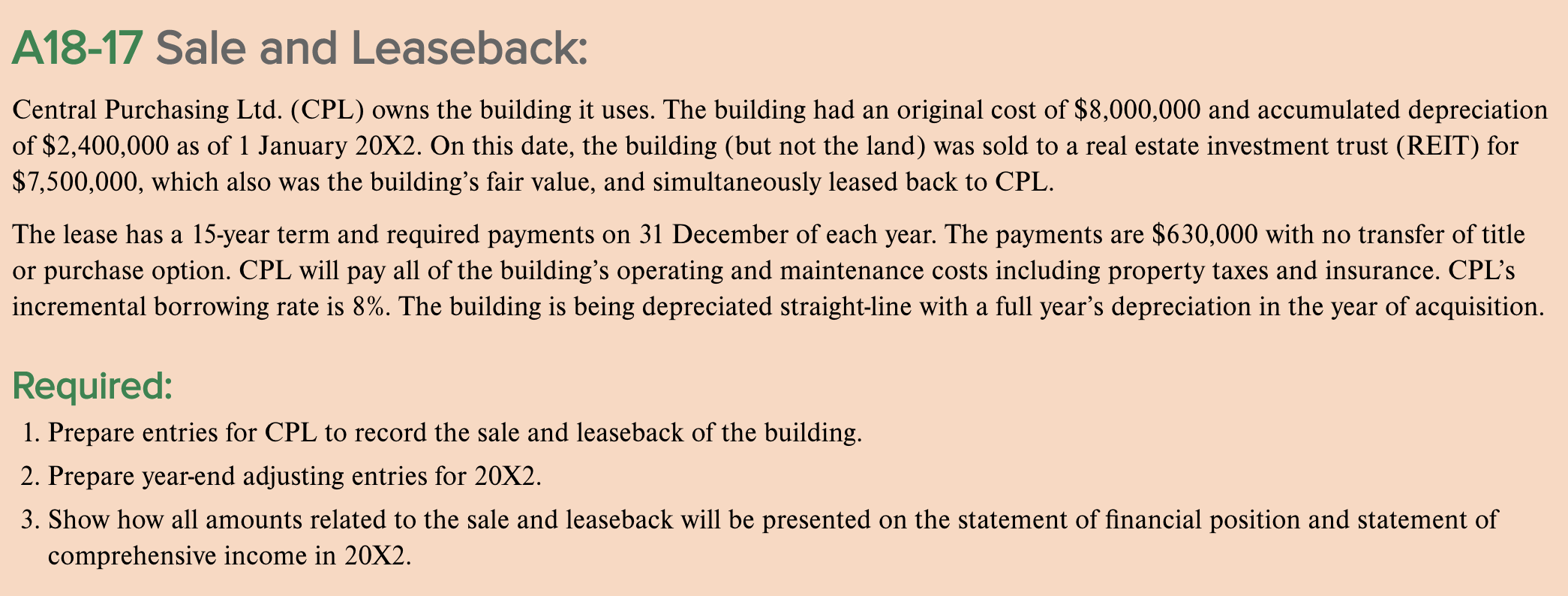

A18-17 Sale and Leaseback: Central Purchasing Ltd. (CPL) owns the building it uses. The building had an original cost of $8,000,000 and accumulated depreciation of $2,400,000 as of 1 January 20X2. On this date, the building (but not the land) was sold to a real estate investment trust (REIT) for $7,500,000, which also was the building's fair value, and simultaneously leased back to CPL. The lease has a 15-year term and required payments on 31 December of each year. The payments are $630,000 with no transfer of title or purchase option. CPL will pay all of the building's operating and maintenance costs including property taxes and insurance. CPL's incremental borrowing rate is 8%. The building is being depreciated straight-line with a full year's depreciation in the year of acquisition. Required: 1. Prepare entries for CPL to record the sale and leaseback of the building. 2. Prepare year-end adjusting entries for 20X2. 3. Show how all amounts related to the sale and leaseback will be presented on the statement of financial position and statement of comprehensive income in 20X2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts