Question: Please show all calculations and logic behind answers. Will rate thumbs up. Longstreet Communications, Inc. (LCI) has a market-value capital structure, which it considers optimal,

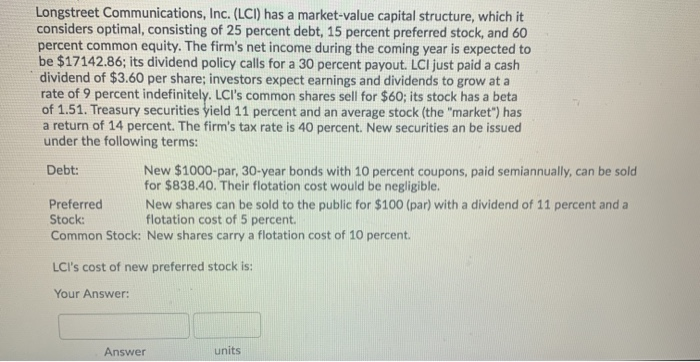

Longstreet Communications, Inc. (LCI) has a market-value capital structure, which it considers optimal, consisting of 25 percent debt, 15 percent preferred stock, and 60 percent common equity. The firm's net income during the coming year is expected to be $17142.86; its dividend policy calls for a 30 percent payout. LCI just paid a cash dividend of $3.60 per share; investors expect earnings and dividends to grow at a rate of 9 percent indefinitely. LCI's common shares sell for $60; its stock has a beta of 1.51. Treasury securities yield 11 percent and an average stock (the "market") has a return of 14 percent. The firm's tax rate is 40 percent. New securities an be issued under the following terms: Debt: New $1000-par, 30-year bonds with 10 percent coupons, paid semiannually, can be sold for $838.40. Their flotation cost would be negligible. Preferred New shares can be sold to the public for $100 (par) with a dividend of 11 percent and a Stock: flotation cost of 5 percent Common Stock: New shares carry a flotation cost of 10 percent. LCI's cost of new preferred stock is: Your Answer: Answer units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts