Question: Please show all calculations and steps since we are doing it by hand without excel or a financial calculator. A company is considering replacing one

Please show all calculations and steps since we are doing it by hand without excel or a financial calculator.

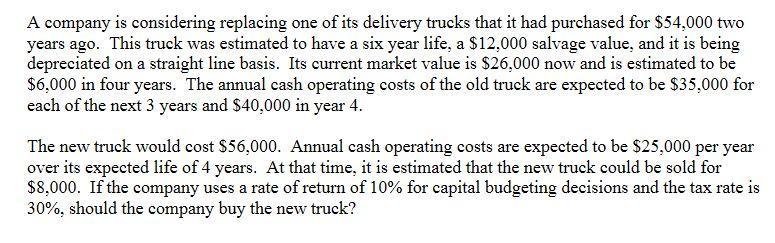

A company is considering replacing one of its delivery trucks that it had purchased for $54,000 two years ago. This truck was estimated to have a six year life, a $12,000 salvage value, and it is being depreciated on a straight line basis. Its current market value is $26,000 now and is estimated to be $6,000 in four years. The annual cash operating costs of the old truck are expected to be $35,000 for each of the next 3 years and $40,000 in year 4. The new truck would cost $56,000. Annual cash operating costs are expected to be $25,000 per year over its expected life of 4 years. At that time, it is estimated that the new truck could be sold for $8,000. If the company uses a rate of return of 10% for capital budgeting decisions and the tax rate is 30%, should the company buy the new truck?

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Final Answer SrNo Option Net Present Value of Cash Outflow 1 ... View full answer

Get step-by-step solutions from verified subject matter experts