Question: please show all calculations for each step, all one question!!! Check my work Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses

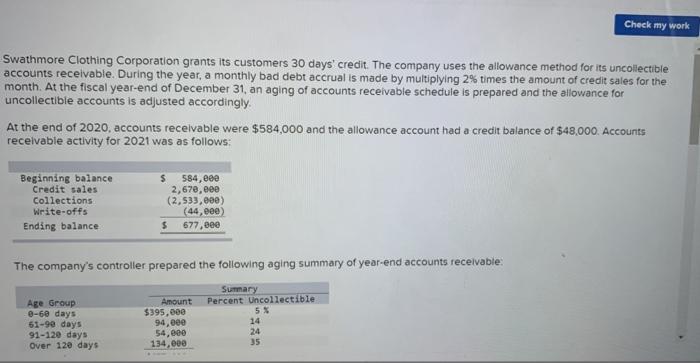

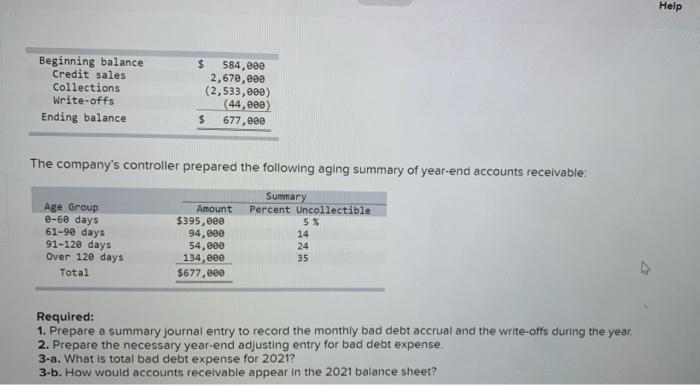

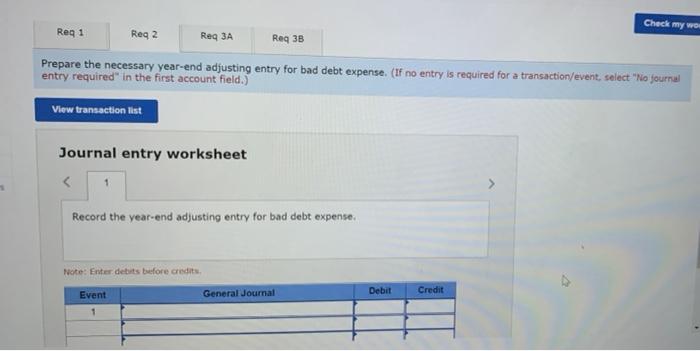

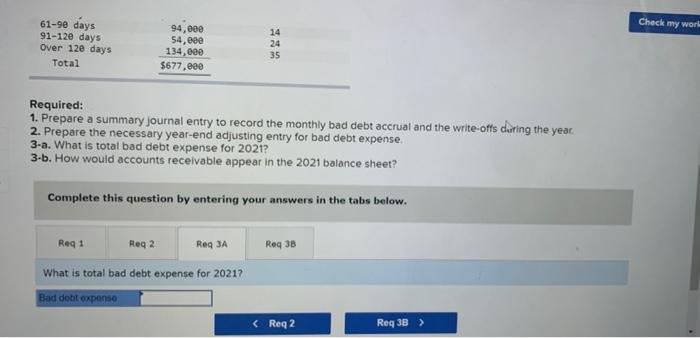

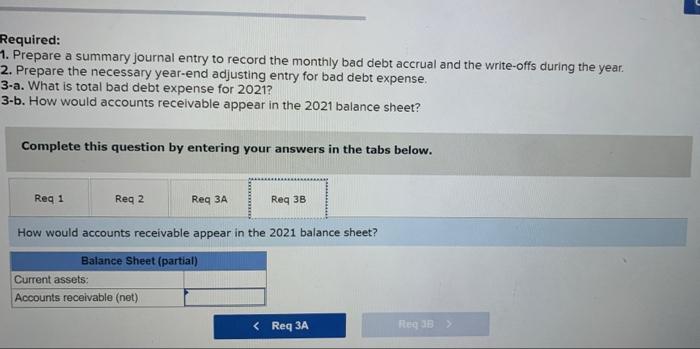

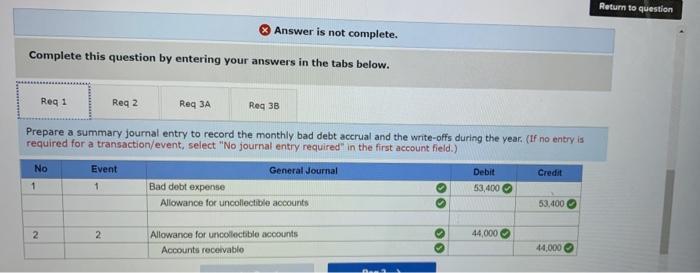

Check my work Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 2% times the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $584,000 and the allowance account had a credit balance of $48.000. Accounts receivable activity for 2021 was as follows: Beginning balance Credit sales Collections Write-offs Ending balance $ 584, eee 2,670, eee (2,533,000) (44,eee) $ 677,000 The company's controller prepared the following aging summary of year-end accounts receivable: Summary Percent Uncollectible 55 Age Group 0-68 days 51-90 days 91-120 days Over 12e days Amount $395,000 94,000 54,000 134,000 14 24 35 Help Beginning balance Credit sales Collections Write-offs Ending balance $ 584,000 2,670,000 (2,533,000) ( 44 , ) $ 677, eee The company's controller prepared the following aging summary of year-end accounts receivable: Age Group 0-60 days 61-90 days 91-120 days Over 120 days Total Amount $395, eee 94,000 54, eee 134,000 5677,000 Summary Percent Uncollectible 5% 14 24 35 Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2021? 3-5. How would accounts receivable appear in the 2021 balance sheet? Check my wo Reg 1 Reg 2 Reg 3A Reg 38 Prepare the necessary year-end adjusting entry for bad debt expense. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2021? 3-b. How would accounts receivable appear in the 2021 balance sheet? Complete this question by entering your answers in the tabs below. Req1 Reg 2 Req 3A Reg 3B How would accounts receivable appear in the 2021 balance sheet? Balance Sheet (partial) Current assets: Accounts receivable (net)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts