Question: Please show all calculations: Question 2 - Estimate Portfolio Return and Risk Compare two alternative strategies to hedge investment in the TSX composite ETF (XIU)

Please show all calculations:

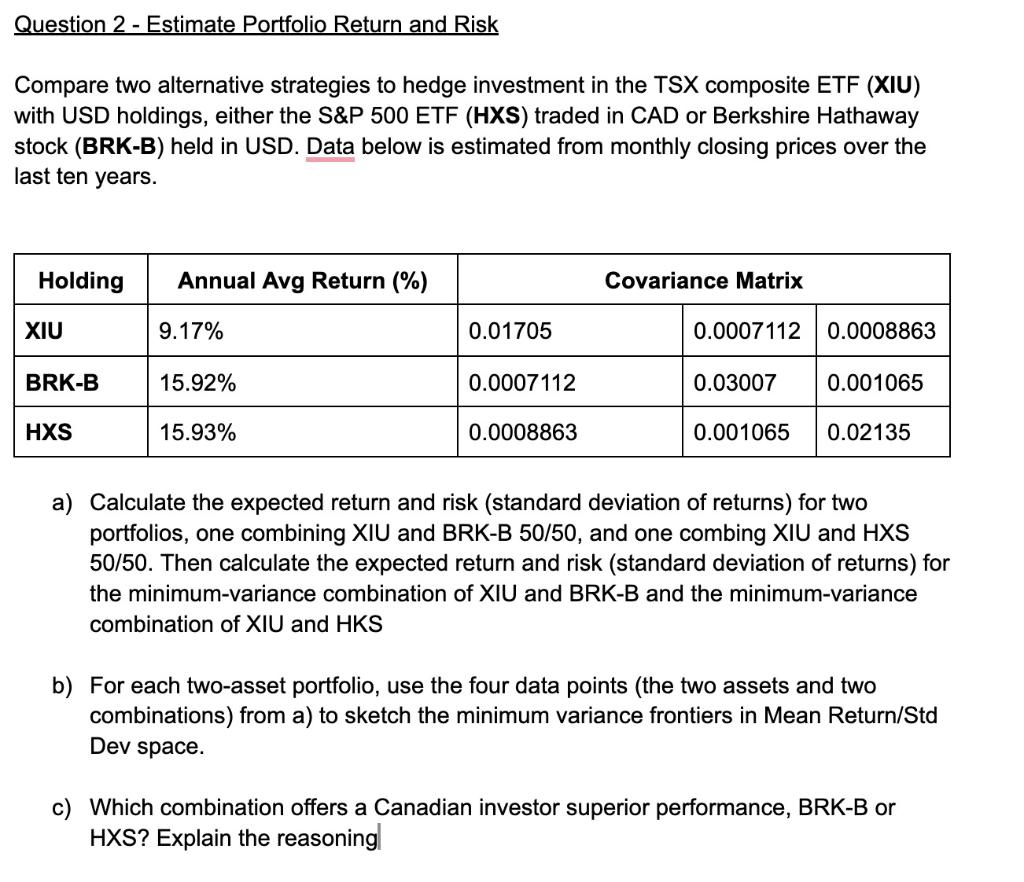

Question 2 - Estimate Portfolio Return and Risk Compare two alternative strategies to hedge investment in the TSX composite ETF (XIU) with USD holdings, either the S\&P 500 ETF (HXS) traded in CAD or Berkshire Hathaway stock (BRK-B) held in USD. Data below is estimated from monthly closing prices over the last ten years. a) Calculate the expected return and risk (standard deviation of returns) for two portfolios, one combining XIU and BRK-B 50/50, and one combing XIU and HXS 50/50. Then calculate the expected return and risk (standard deviation of returns) for the minimum-variance combination of XIU and BRK-B and the minimum-variance combination of XIU and HKS b) For each two-asset portfolio, use the four data points (the two assets and two combinations) from a) to sketch the minimum variance frontiers in Mean Return/Std Dev space. c) Which combination offers a Canadian investor superior performance, BRK-B or HXS ? Explain the reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts