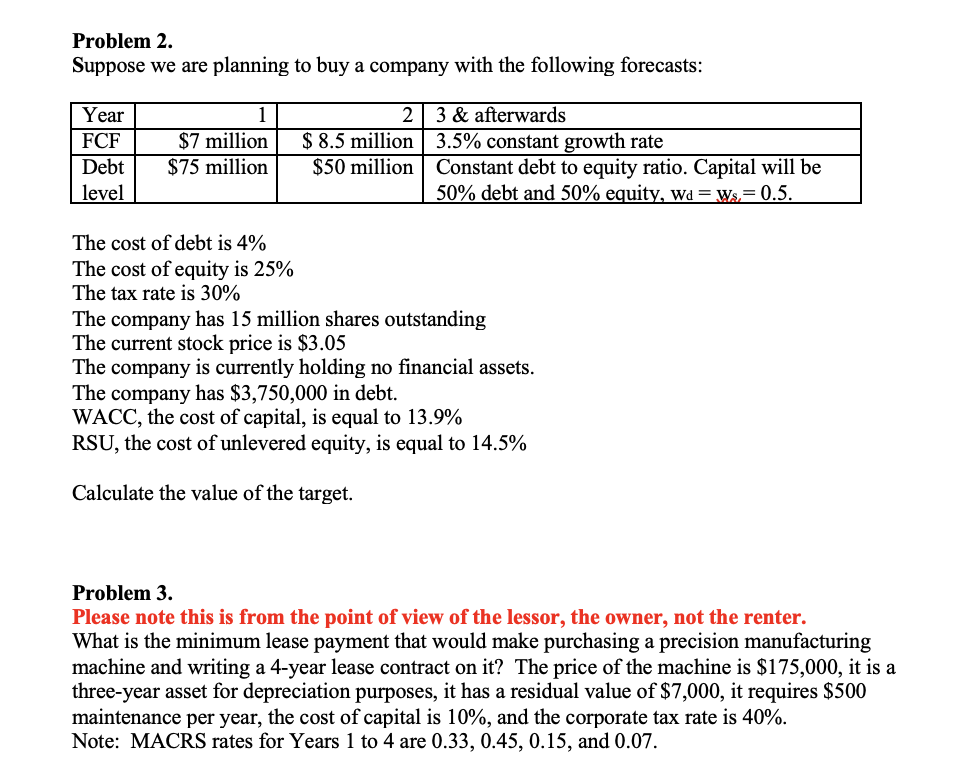

Question: PLEASE SHOW ALL CALCULATIONS/EXCEL WORK Problem 2. Suppose we are planning to buy a company with the following forecasts: Debt $75 million Constant debt to

PLEASE SHOW ALL CALCULATIONS/EXCEL WORK

Problem 2. Suppose we are planning to buy a company with the following forecasts: Debt $75 million Constant debt to equity ratio. Capital will be level 50% debt and 50% - ' . . The cost of debt is 4% The cost of equity is 25% The tax rate is 30% The company has 15 million shares outstanding The current stock price is $3.05 The company is currently holding no nancial assets. The company has $3,750,000 in debt. WACC, the cost of capital, is equal to 13.9% RSU, the cost of unlevered equity, is equal to 14.5% Calculate the value of the target. Problem 3. Please note this is from the point of view of the lessor, the owner, not the renter. What is the minimum lease payment that would make purchasing a precision manufacturing machine and writing a 4-year lease contract on it? The price of the machine is $135,000, it is a three-year asset for depreciation purposes, it has a residual value of $7,000, it requires $500 maintenance per year, the cost of capital is 10%, and the corporate tax rate is 40%. Note: MACRS rates for Years 1 to 4 are 0.33, 0.45, 0.15, and 0.07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts