Question: Please show all equations and work as needed. Imagine a world with 3 investment options. You have the following information: Beta 0.15 0.45 0.60 E[r]

Please show all equations and work as needed.

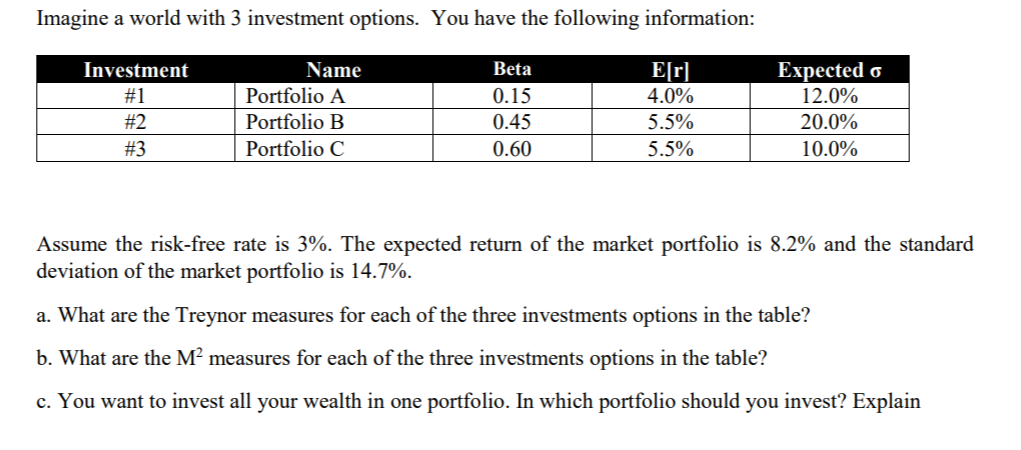

Imagine a world with 3 investment options. You have the following information: Beta 0.15 0.45 0.60 E[r] 4.0% 5.5% 5.5% Investment #1 #2 #3 Name Expected 12.0% 20.0% 10.0% Portfolio A Portfolio B Portfolio C Assume the risk-free rate is 3%. The expected return of the market portfolio is 8.2% and the standard deviation of the market portfolio is 14.7% a. What are the Trevnor measures for each of the three investments options in the table? b. What are the M measures for each of the three investments options in the table? c. You want to invest all your wealth in one portfolio. In which portfolio should you invest? Explain Imagine a world with 3 investment options. You have the following information: Beta 0.15 0.45 0.60 E[r] 4.0% 5.5% 5.5% Investment #1 #2 #3 Name Expected 12.0% 20.0% 10.0% Portfolio A Portfolio B Portfolio C Assume the risk-free rate is 3%. The expected return of the market portfolio is 8.2% and the standard deviation of the market portfolio is 14.7% a. What are the Trevnor measures for each of the three investments options in the table? b. What are the M measures for each of the three investments options in the table? c. You want to invest all your wealth in one portfolio. In which portfolio should you invest? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts