Question: Please show all equations and work where necessary. 5. Given the capital allocation line, an investor's optimal portfolio is the portfolio that A. maximizes her

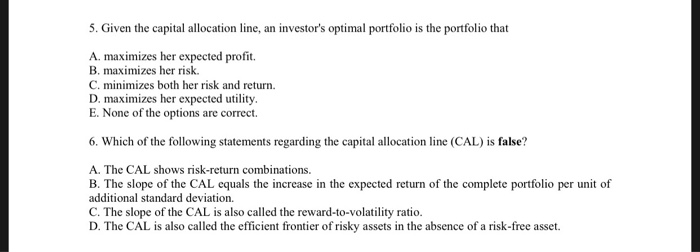

5. Given the capital allocation line, an investor's optimal portfolio is the portfolio that A. maximizes her expected profit. B. maximizes her risk. C. minimizes both her risk and return D. maximizes her expected utility E. None of the options are correct. 6. Which of the following statements regarding the capital allocation line (CAL) is false? A. The CAL shows risk-return combinations. B. The slope of the CAL equals the increase in the expected return of the complete portfolio per unit of additional standard deviation. C. The slope of the CAL is also called the reward-to-volatility ratio. D. The CAL is also called the efficient frontier of risky assets in the absence of a risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts