Question: Please show all equations and work where necessary. 9. Consider a T-bill with a rate of return of 5% and the following risky securities: Security

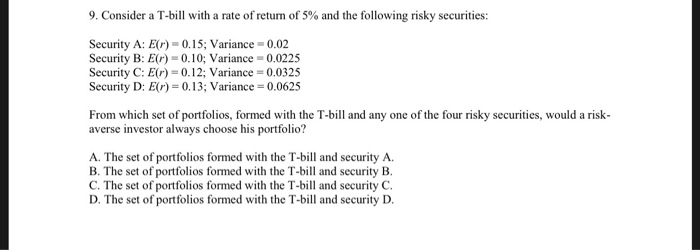

9. Consider a T-bill with a rate of return of 5% and the following risky securities: Security A: E(r 0.15; Variance- 0.02 Security B:E-0.10; Variance 0.0225 Security C: E(r) 0.12; Variance 0.0325 Security D: Er) 0.13; Variance 0.0625 From which set of portfolios, formed with the T-bill and any one of the four risky securities, would a risk averse investor always choose his portfolio? A. The set of portfolios formed with the T-bill and security A. B. The set of portfolios formed with the T-bill and security B. C. The set of portfolios formed with the T-bill and security C D. The set of portfolios formed with the T-bill and security D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts