Question: Please show all excel work including equations Question 1 60 pts After paying a consultant $4,000 for a market analysis, a small computer supply company

Please show all excel work including equations

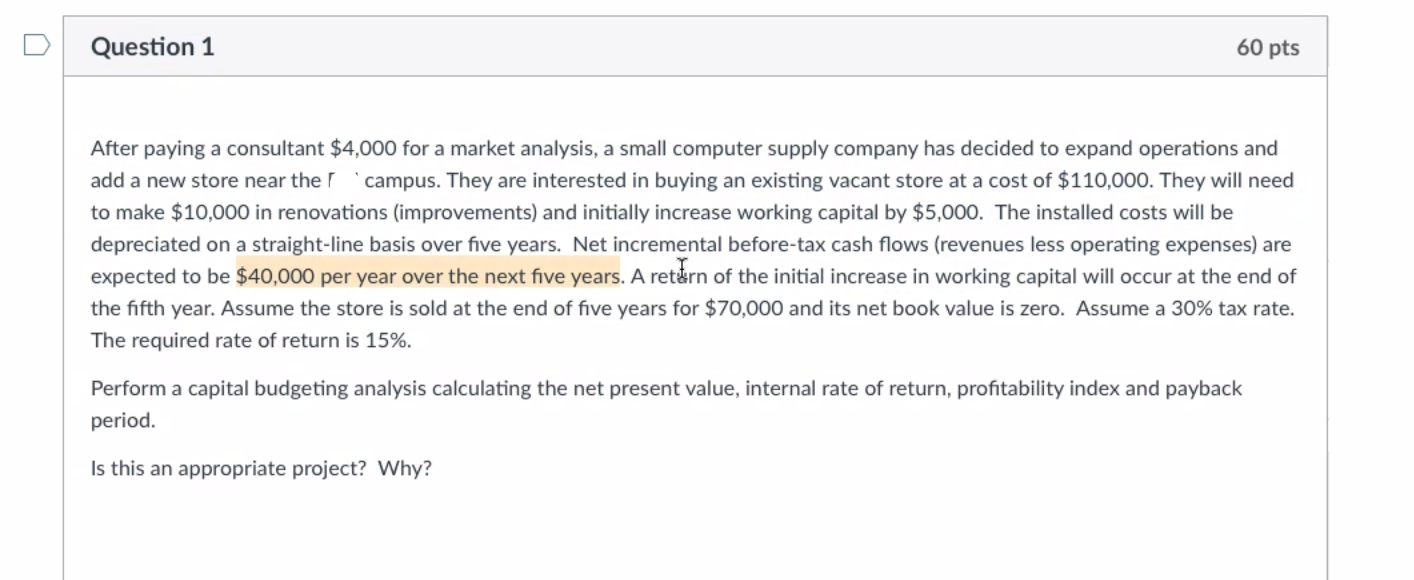

Question 1 60 pts After paying a consultant $4,000 for a market analysis, a small computer supply company has decided to expand operations and add a new store near the campus. They are interested in buying an existing vacant store at a cost of $110,000. They will need to make $10,000 in renovations (improvements) and initially increase working capital by $5,000. The installed costs will be depreciated on a straight-line basis over five years. Net incremental before-tax cash flows (revenues less operating expenses) are expected to be $40,000 per year over the next five years. A retrn of the initial increase in working capital will occur at the end of the fifth year. Assume the store is sold at the end of five years for $70,000 and its net book value is zero. Assume a 30% tax rate. The required rate of return is 15%. Perform a capital budgeting analysis calculating the net present value, internal rate of return, profitability index and payback period. Is this an appropriate project? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts