Question: Please show all formulas and work done for every problem Problem 12: Martin has deposited $375 in his IRA at the end of each quarter

Please show all formulas and work done for every problem

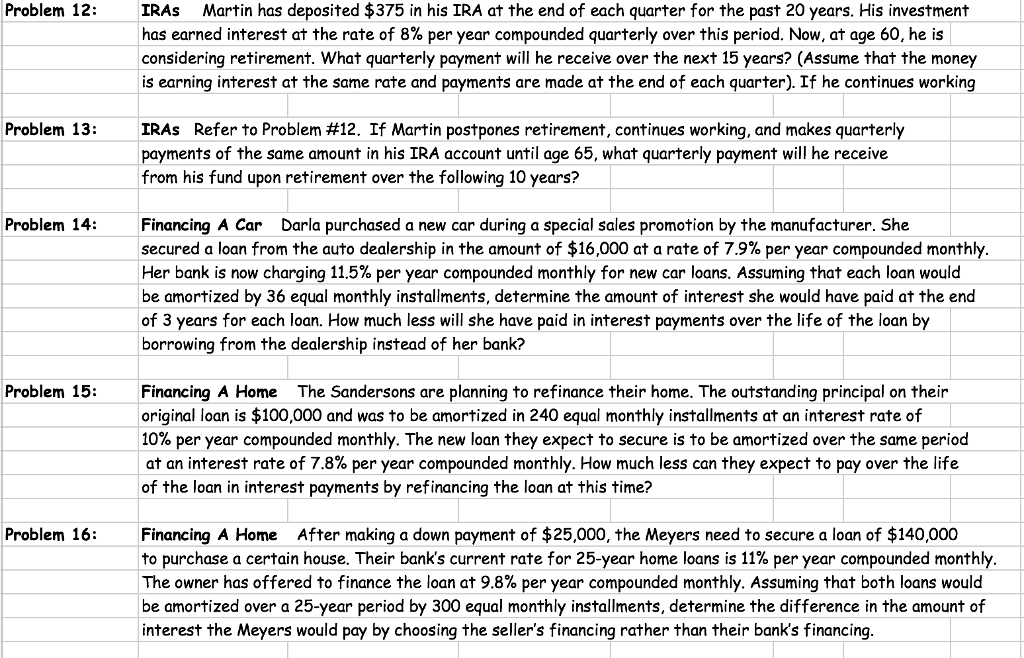

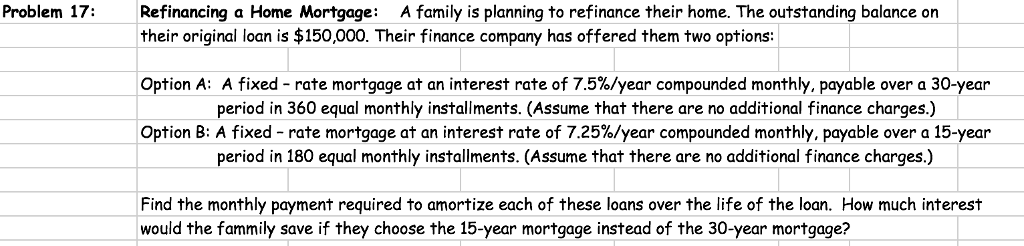

Problem 12: Martin has deposited $375 in his IRA at the end of each quarter for the past 20 years. His investment IRAs has earned interest at the rate of 8% per year compounded quarterly over this period. Now, at age 60, he is considering retirement. What quarterly payment will he receive over the next 15 years? (Assume that the mone is earning interest at the same rate and payments are made at the end of each quarter). If he continues working IRAs Refer to Problem #12. If Martin postpones retirement, continues working, and makes quarterly payments of the same amount in his IRA account until age 65, what quarterly payment will he receive from his fund upon retirement over the following 10 years? Problem 13: Problem 14:Financing A Car Darla purchased a new car during a special sales promotion by the manufacturer. She secured a loan from the auto dealership in the amount of $16,000 at a rate of 7.9% per year compounded monthly Her bank is now charging 11.5% per year compounded monthly for new car loans. Assuming that each loan would be amortized by 36 equal monthly installments, determine the amount of interest she would have paid at the end of 3 years for each loan. How much less will she have paid in interest payments over the life of the loan by borrowing from the dealership instead of her bank? Problem 15:Financing A Home The Sandersons are planning to refinance their home. The outstanding principal on their original loan is $100,000 and was to be amortized in 240 equal monthly installments at an interest rate of 10% per year compounded monthly. The new loan they expect to secure is to be amortized over the same period at an interest rate of 7.8% per year compounded monthly. How much less can they expect to pay over the life of the loan in interest payments by refinancing the loan at this time? Financing A Home After making a down payment of $25,000, the Meyers need to secure a loan of $140,000 to purchase a certain house. Their bank's current rate for 25-year home loans is 11% per year compounded monthly The owner has offered to finance the loan at 9.8% per year compounded monthly. Assuming that both loans would be amortized over a 25-year period by 300 equal monthly installments, determine the difference in the amount of interest the Meyers would pay by choosing the seller's financing rather than their bank's financing Problem 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts