Question: PLEASE SHOW ALL FORMULAS!!! NO RAW NUMBERS L A B D E F G H 1 3/27/12 2 Chapter: 5 3 Problem: 24 4 5

PLEASE SHOW ALL FORMULAS!!! NO RAW NUMBERS

PLEASE SHOW ALL FORMULAS!!! NO RAW NUMBERS

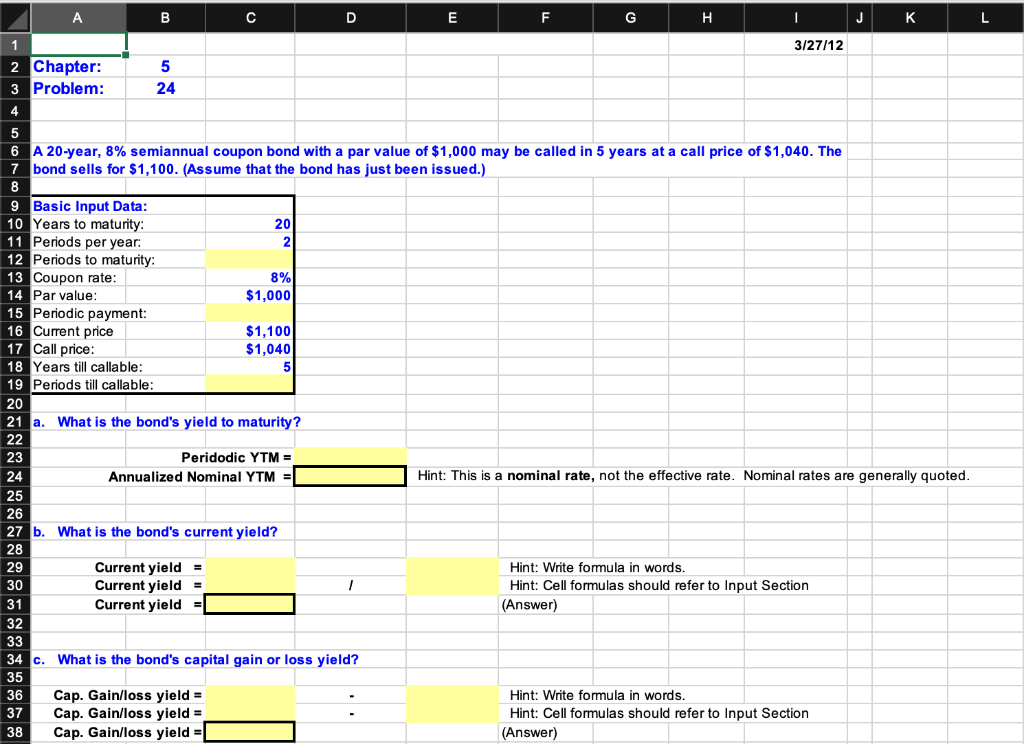

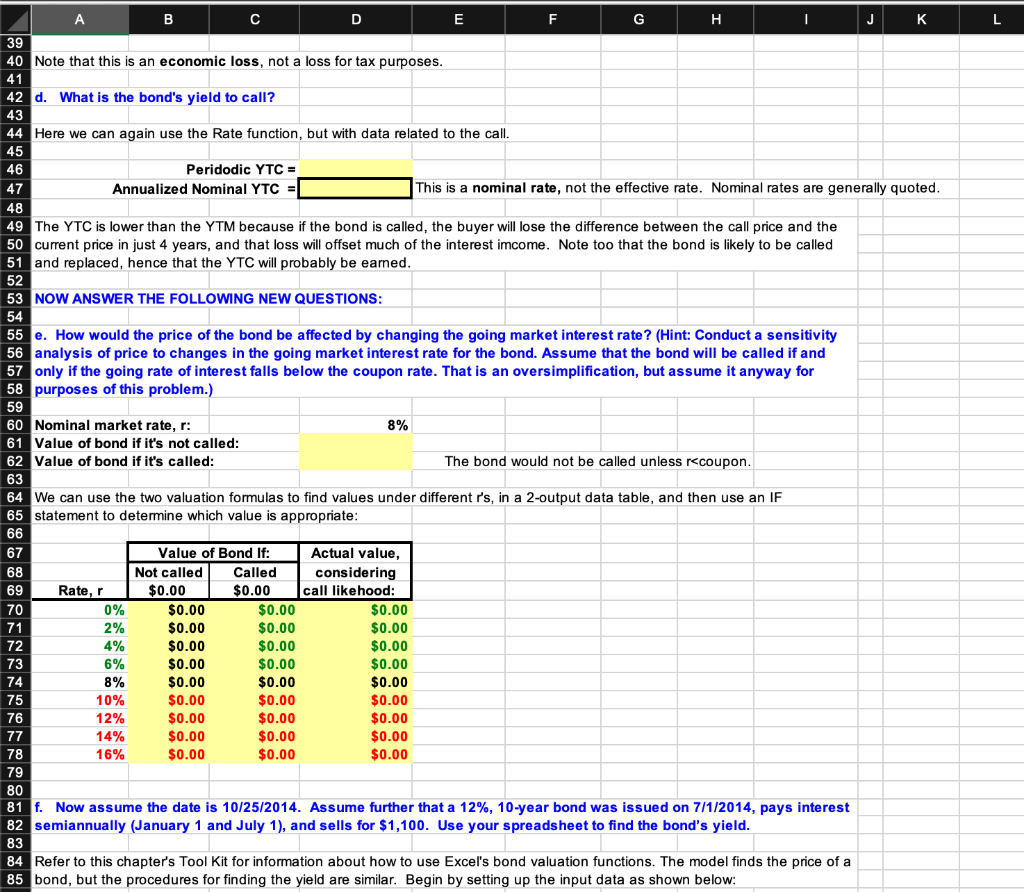

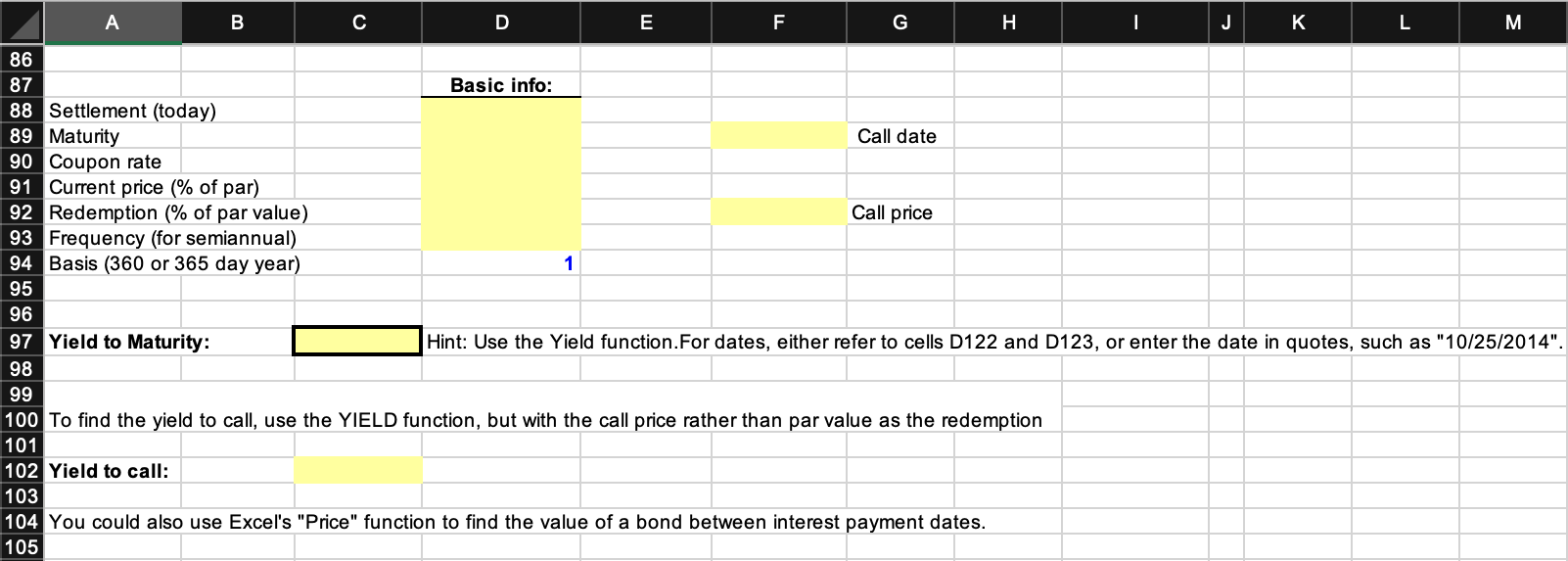

L A B D E F G H 1 3/27/12 2 Chapter: 5 3 Problem: 24 4 5 6 A 20-year, 8% semiannual coupon bond with a par value of $1,000 may be called in 5 years at a call price of $1,040. The 7 bond sells for $1,100. (Assume that the bond has just been issued.) 8 9 Basic Input Data: 10 Years to maturity: 20 11 Periods per year: 2 12 Periods to maturity: 13 Coupon rate: 8% 14 Par value: $1,000 15 Periodic payment: 16 Current price $1,100 17 Call price: $1,040 18 Years till callable: 5 19 Periods till callable: 20 21 a. What is the bond's yield to maturity? 22 23 Peridodic YTM = 24 Annualized Nominal YTM Hint: This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 25 26 27 b. What is the bond's current yield? 28 29 Current yield = Hint: Write formula in words. 30 Current yield = 1 Hint: Cell formulas should refer to Input Section 31 Current yield = (Answer) 32 33 34 c. What is the bond's capital gain or loss yield? 35 36 Cap. Gain/loss yield = Hint: Write formula in words. 37 Cap. Gain/loss yield = Hint: Cell formulas should refer to Input Section 38 Cap. Gain/loss yield = (Answer) L B C D E F G H I J 39 40 Note that this is an economic loss, not a loss for tax purposes. 41 42 d. What is the bond's yield to call? 43 44 Here we can again use the Rate function, but with data related to the call. 45 46 Peridodic YTC = 47 Annualized Nominal YTC = This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 48 49 The YTC is lower than the YTM because if the bond is called, the buyer will lose the difference between the call price and the 50 current price in just 4 years, and that loss will offset much of the interest imcome. Note too that the bond is likely to be called 51 and replaced, hence that the YTC will probably be eamed. 52 53 NOW ANSWER THE FOLLOWING NEW QUESTIONS: 54 55 e. How would the price of the bond be affected by changing the going market interest rate? (Hint: Conduct a sensitivity 56 analysis of price to changes in the going market interest rate for the bond. Assume that the bond will be called if and 57 only if the going rate of interest falls below the coupon rate. That is an oversimplification, but assume it anyway for 58 purposes of this problem.) 59 60 Nominal market rate, r: 8% 61 Value of bond it's not called: 62 Value of bond if it's called: The bond would not be called unless coupon. 63 64 We can use the two valuation formulas to find values under different I's, in a 2-output data table, and then use an IF 65 statement to determine which value is appropriate: 66 67 Value of Bond If: Actual value, 68 Not called Called considering 69 Rate, r $0.00 $0.00 call likehood: 70 0% $0.00 $0.00 $0.00 71 2% $0.00 $0.00 $0.00 72 4% $0.00 $0.00 $0.00 73 6% $0.00 $0.00 $0.00 74 8% $0.00 $0.00 $0.00 75 10% $0.00 $0.00 $0.00 76 12% $0.00 $0.00 $0.00 77 14% $0.00 $0.00 $0.00 78 16% $0.00 $0.00 $0.00 79 80 81 f. Now assume the date is 10/25/2014. Assume further that a 12%, 10-year bond was issued on 7/1/2014, pays interest 82 semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's yield. 83 84 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the price of a 85 bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below: A B C D E F G H I J L M Call price 86 87 Basic info: 88 Settlement (today) 89 Maturity Call date 90 Coupon rate 91 Current price (% of par) 92 Redemption (% of par value) 93 Frequency (for semiannual) 94 Basis (360 or 365 day year) 1 95 96 97 Yield to Maturity: Hint: Use the Yield function. For dates, either refer to cells D122 and D123, or enter the date in quotes, such as "10/25/2014". 98 99 100 To find the yield to call, use the YIELD function, but with the call price rather than par value as the redemption 101 102 Yield to call: 103 104 You could also use Excel's "Price" function to find the value of a bond between interest payment dates. 105 L A B D E F G H 1 3/27/12 2 Chapter: 5 3 Problem: 24 4 5 6 A 20-year, 8% semiannual coupon bond with a par value of $1,000 may be called in 5 years at a call price of $1,040. The 7 bond sells for $1,100. (Assume that the bond has just been issued.) 8 9 Basic Input Data: 10 Years to maturity: 20 11 Periods per year: 2 12 Periods to maturity: 13 Coupon rate: 8% 14 Par value: $1,000 15 Periodic payment: 16 Current price $1,100 17 Call price: $1,040 18 Years till callable: 5 19 Periods till callable: 20 21 a. What is the bond's yield to maturity? 22 23 Peridodic YTM = 24 Annualized Nominal YTM Hint: This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 25 26 27 b. What is the bond's current yield? 28 29 Current yield = Hint: Write formula in words. 30 Current yield = 1 Hint: Cell formulas should refer to Input Section 31 Current yield = (Answer) 32 33 34 c. What is the bond's capital gain or loss yield? 35 36 Cap. Gain/loss yield = Hint: Write formula in words. 37 Cap. Gain/loss yield = Hint: Cell formulas should refer to Input Section 38 Cap. Gain/loss yield = (Answer) L B C D E F G H I J 39 40 Note that this is an economic loss, not a loss for tax purposes. 41 42 d. What is the bond's yield to call? 43 44 Here we can again use the Rate function, but with data related to the call. 45 46 Peridodic YTC = 47 Annualized Nominal YTC = This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 48 49 The YTC is lower than the YTM because if the bond is called, the buyer will lose the difference between the call price and the 50 current price in just 4 years, and that loss will offset much of the interest imcome. Note too that the bond is likely to be called 51 and replaced, hence that the YTC will probably be eamed. 52 53 NOW ANSWER THE FOLLOWING NEW QUESTIONS: 54 55 e. How would the price of the bond be affected by changing the going market interest rate? (Hint: Conduct a sensitivity 56 analysis of price to changes in the going market interest rate for the bond. Assume that the bond will be called if and 57 only if the going rate of interest falls below the coupon rate. That is an oversimplification, but assume it anyway for 58 purposes of this problem.) 59 60 Nominal market rate, r: 8% 61 Value of bond it's not called: 62 Value of bond if it's called: The bond would not be called unless coupon. 63 64 We can use the two valuation formulas to find values under different I's, in a 2-output data table, and then use an IF 65 statement to determine which value is appropriate: 66 67 Value of Bond If: Actual value, 68 Not called Called considering 69 Rate, r $0.00 $0.00 call likehood: 70 0% $0.00 $0.00 $0.00 71 2% $0.00 $0.00 $0.00 72 4% $0.00 $0.00 $0.00 73 6% $0.00 $0.00 $0.00 74 8% $0.00 $0.00 $0.00 75 10% $0.00 $0.00 $0.00 76 12% $0.00 $0.00 $0.00 77 14% $0.00 $0.00 $0.00 78 16% $0.00 $0.00 $0.00 79 80 81 f. Now assume the date is 10/25/2014. Assume further that a 12%, 10-year bond was issued on 7/1/2014, pays interest 82 semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's yield. 83 84 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the price of a 85 bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below: A B C D E F G H I J L M Call price 86 87 Basic info: 88 Settlement (today) 89 Maturity Call date 90 Coupon rate 91 Current price (% of par) 92 Redemption (% of par value) 93 Frequency (for semiannual) 94 Basis (360 or 365 day year) 1 95 96 97 Yield to Maturity: Hint: Use the Yield function. For dates, either refer to cells D122 and D123, or enter the date in quotes, such as "10/25/2014". 98 99 100 To find the yield to call, use the YIELD function, but with the call price rather than par value as the redemption 101 102 Yield to call: 103 104 You could also use Excel's "Price" function to find the value of a bond between interest payment dates. 105

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts