Question: Please show all formulas used and numbers in excel Problem ABC Fund has decided to enter into a joint venture with Newtown Development Inc. to

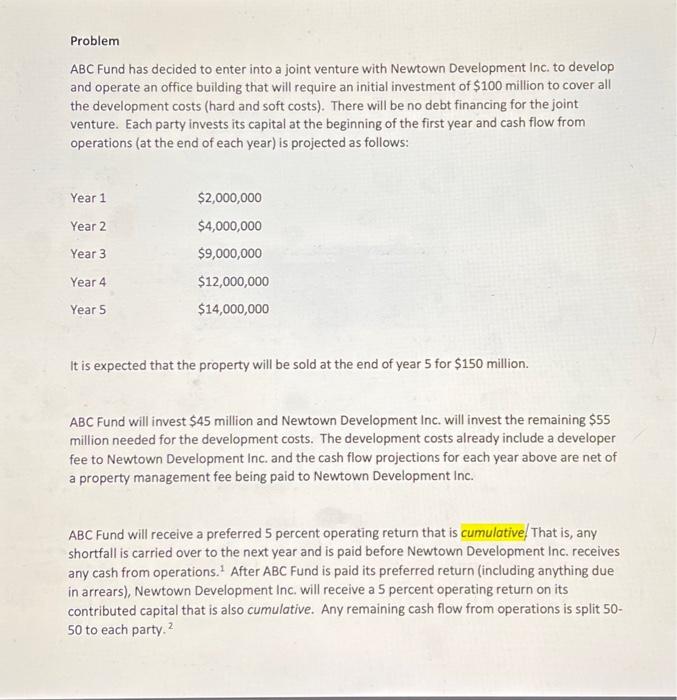

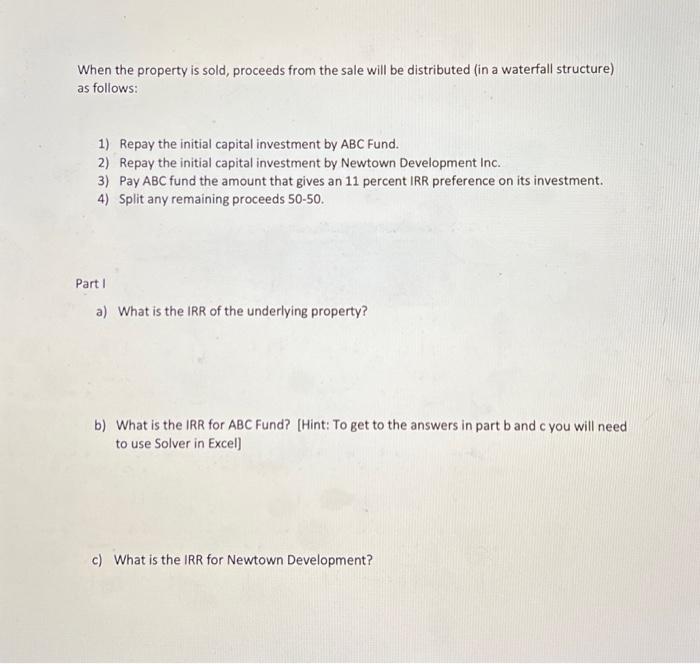

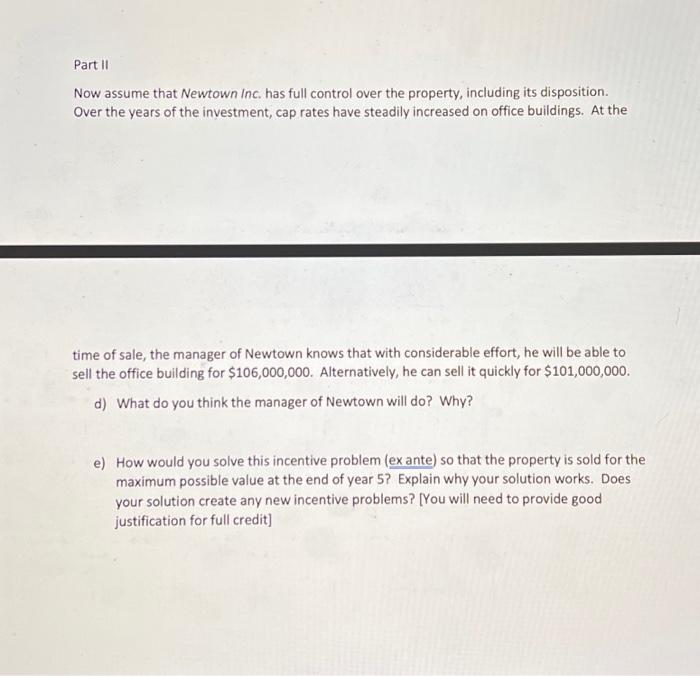

Problem ABC Fund has decided to enter into a joint venture with Newtown Development Inc. to develop and operate an office building that will require an initial investment of $100 million to cover all the development costs (hard and soft costs). There will be no debt financing for the joint venture. Each party invests its capital at the beginning of the first year and cash flow from operations (at the end of each year) is projected as follows: It is expected that the property will be sold at the end of year 5 for $150 million. ABC Fund will invest $45 million and Newtown Development Inc. will invest the remaining $55 million needed for the development costs. The development costs already include a developer fee to Newtown Development Inc. and the cash flow projections for each year above are net of a property management fee being paid to Newtown Development inc. ABC Fund will receive a preferred 5 percent operating return that is cumulative/ That is, any shortfall is carried over to the next year and is paid before Newtown Development Inc. receives any cash from operations. 1 After ABC Fund is paid its preferred return (including anything due in arrears), Newtown Development Inc. will receive a 5 percent operating return on its contributed capital that is also cumulative. Any remaining cash flow from operations is split 50 50 to each party. 2 When the property is sold, proceeds from the sale will be distributed (in a waterfall structure) as follows: 1) Repay the initial capital investment by ABC Fund. 2) Repay the initial capital investment by Newtown Development Inc. 3) Pay ABC fund the amount that gives an 11 percent IRR preference on its investment. 4) Split any remaining proceeds 5050. Part I a) What is the IRR of the underlying property? b) What is the IRR for ABC Fund? [Hint: To get to the answers in part b and c you will need to use Solver in Excel] c) What is the IRR for Newtown Development? Part II Now assume that Newtown Inc. has full control over the property, including its disposition. Over the years of the investment, cap rates have steadily increased on office buildings. At the time of sale, the manager of Newtown knows that with considerable effort, he will be able to sell the office building for $106,000,000. Alternatively, he can sell it quickly for $101,000,000. d) What do you think the manager of Newtown will do? Why? e) How would you solve this incentive problem (exante) so that the property is sold for the maximum possible value at the end of year 5 ? Explain why your solution works. Does your solution create any new incentive problems? [You will need to provide good justification for full credit]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts