Question: Please show all formulas/calculations. Thanks! Question 2 Capital Corp is considering the acquisition of NewSoft Inc. Because NewSoft is privately held, the CEO of Capital

Please show all formulas/calculations. Thanks!

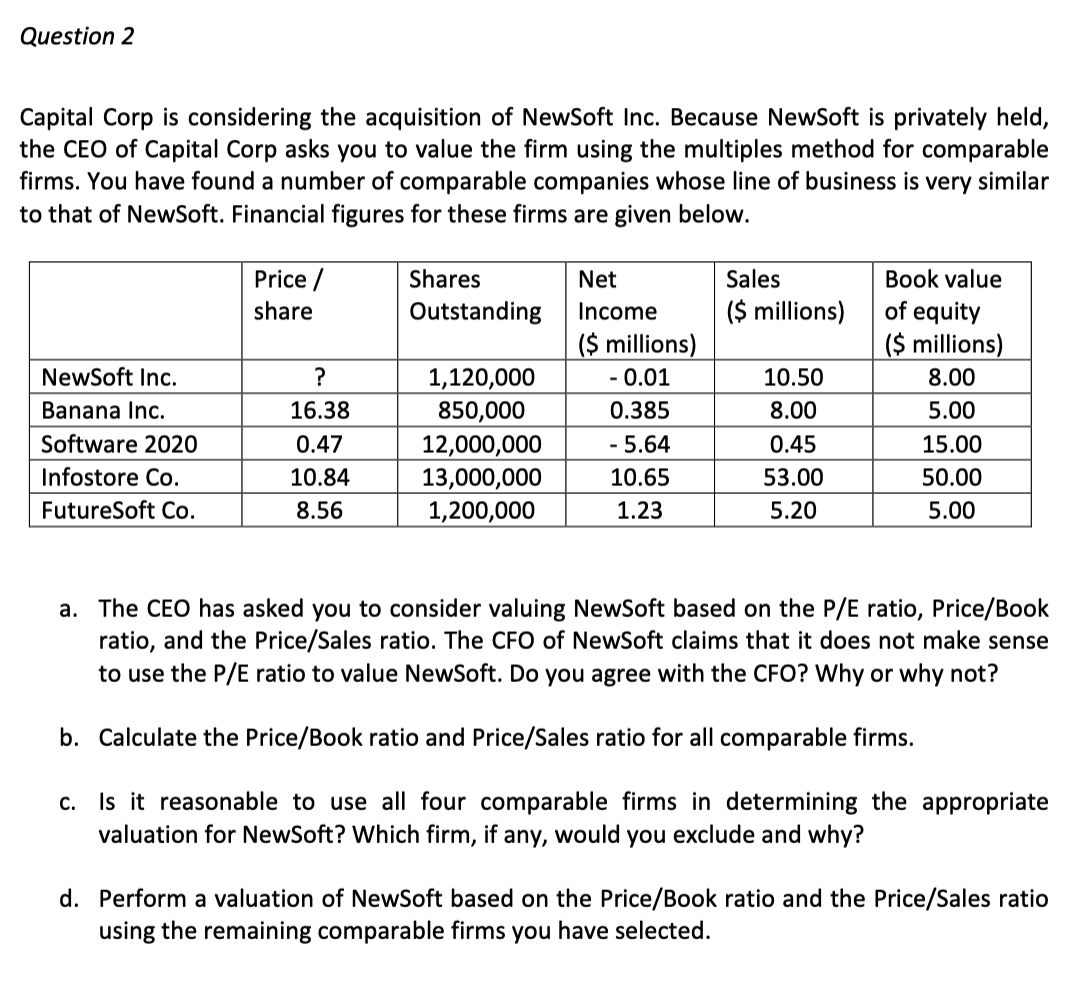

Question 2 Capital Corp is considering the acquisition of NewSoft Inc. Because NewSoft is privately held, the CEO of Capital Corp asks you to value the firm using the multiples method for comparable firms. You have found a number of comparable companies whose line of business is very similar to that of NewSoft. Financial figures for these firms are given below. Price / share Shares Outstanding Sales ($ millions) NewSoft Inc. Banana Inc. Software 2020 Infostore Co. FutureSoft Co. ? 16.38 0.47 10.84 8.56 1,120,000 850,000 12,000,000 13,000,000 1,200,000 Net Income ($ millions) -0.01 0.385 - 5.64 10.65 1.23 10.50 8.00 0.45 53.00 5.20 Book value of equity ($ millions) 8.00 5.00 15.00 50.00 5.00 a. The CEO has asked you to consider valuing NewSoft based on the P/E ratio, Price/Book ratio, and the Price/Sales ratio. The CFO of NewSoft claims that it does not make sense to use the P/E ratio to value NewSoft. Do you agree with the CFO? Why or why not? b. Calculate the Price/Book ratio and Price/Sales ratio for all comparable firms. C. Is it reasonable to use all four comparable firms in determining the appropriate valuation for NewSoft? Which firm, if any, would you exclude and why? d. Perform a valuation of NewSoft based on the Price/Book ratio and the Price/Sales ratio using the remaining comparable firms you have selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts