Question: Please show all hand written work with all the steps shown. This is a course in Life Contingency. I will give a thumbs-up for a

Please show all hand written work with all the steps shown. This is a course in Life Contingency. I will give a thumbs-up for a clear and concise solution. Thanks in advance!

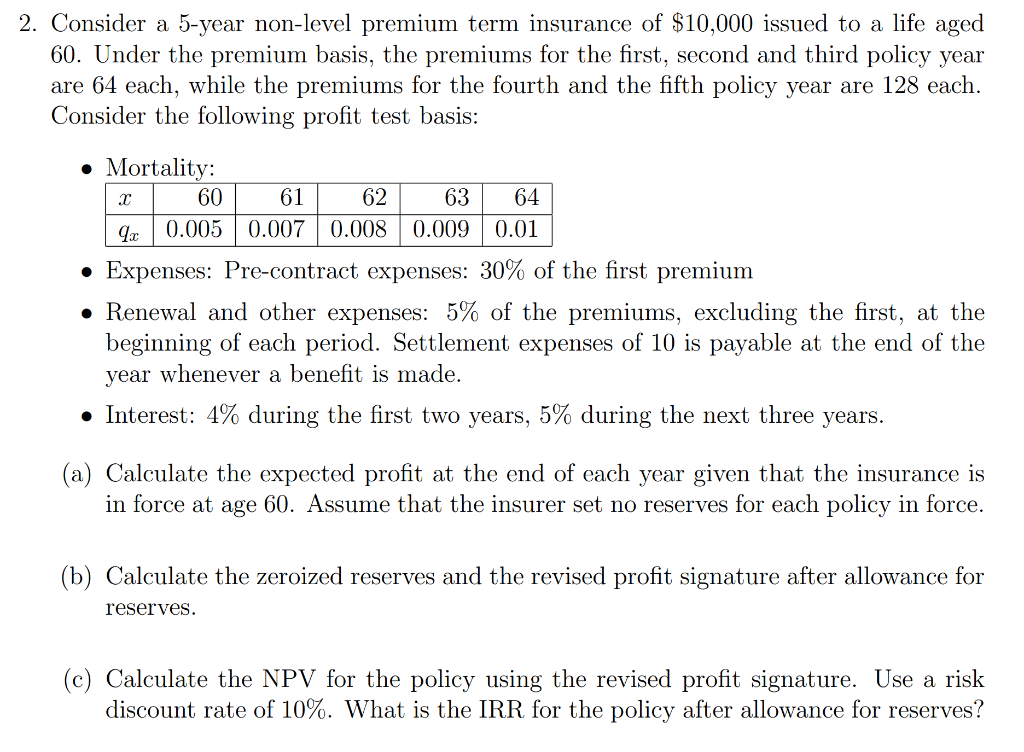

2. Consider a 5-year non-level premium term insurance of $10,000 issued to a life aged 60. Under the premium basis, the premiums for the first, second and third policy year are 64 each, while the premiums for the fourth and the fifth policy year are 128 each. Consider the following profit test basis: Mortality: 60 63 61 0.007 62 0.008 64 0.01 9c 0.005 0.009 . Expenses: Pre-contract expenses: 30% of the first premium Renewal and other expenses: 5% of the premiums, excluding the first, at the beginning of each period. Settlement expenses of 10 is payable at the end of the year whenever a benefit is made. Interest: 4% during the first two years, 5% during the next three years. (a) Calculate the expected profit at the end of each year given that the insurance is in force at age 60. Assume that the insurer set no reserves for each policy in force. (b) Calculate the zeroized reserves and the revised profit signature after allowance for reserves. (C) Calculate the NPV for the policy using the revised profit signature. Use a risk discount rate of 10%. What is the IRR for the policy after allowance for reserves? 2. Consider a 5-year non-level premium term insurance of $10,000 issued to a life aged 60. Under the premium basis, the premiums for the first, second and third policy year are 64 each, while the premiums for the fourth and the fifth policy year are 128 each. Consider the following profit test basis: Mortality: 60 63 61 0.007 62 0.008 64 0.01 9c 0.005 0.009 . Expenses: Pre-contract expenses: 30% of the first premium Renewal and other expenses: 5% of the premiums, excluding the first, at the beginning of each period. Settlement expenses of 10 is payable at the end of the year whenever a benefit is made. Interest: 4% during the first two years, 5% during the next three years. (a) Calculate the expected profit at the end of each year given that the insurance is in force at age 60. Assume that the insurer set no reserves for each policy in force. (b) Calculate the zeroized reserves and the revised profit signature after allowance for reserves. (C) Calculate the NPV for the policy using the revised profit signature. Use a risk discount rate of 10%. What is the IRR for the policy after allowance for reserves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts