Question: Please show ALL of your work. I know the answer but I need all work shown as well as formulas to understand the lovic behind

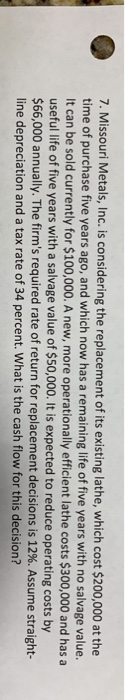

7. Missouri Metals, Inc. is considering the replacement of its existing lathe, which cost $200,000 at the time of purchase five years ago, and which now has a remaining life of five years with no salvage value. It can be sold currently for $100,000. A new, more operationally efficient lathe costs $300,000 and has a useful life of five years with a salvage value of $50,000. It is expected to reduce operating costs by $66,000 annually. The firm's required rate of return for replacement decisions is 12%. Assume straight- line depreciation and a tax rate of 34 percent. What is the cash flow for this decision? 7. Missouri Metals, Inc. is considering the replacement of its existing lathe, which cost $200,000 at the time of purchase five years ago, and which now has a remaining life of five years with no salvage value. It can be sold currently for $100,000. A new, more operationally efficient lathe costs $300,000 and has a useful life of five years with a salvage value of $50,000. It is expected to reduce operating costs by $66,000 annually. The firm's required rate of return for replacement decisions is 12%. Assume straight- line depreciation and a tax rate of 34 percent. What is the cash flow for this decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts