Question: please show all process and excel formulas Certain companies exclusively use the discounted payback period method to select their investments. Right now, you are faced

please show all process and excel formulas

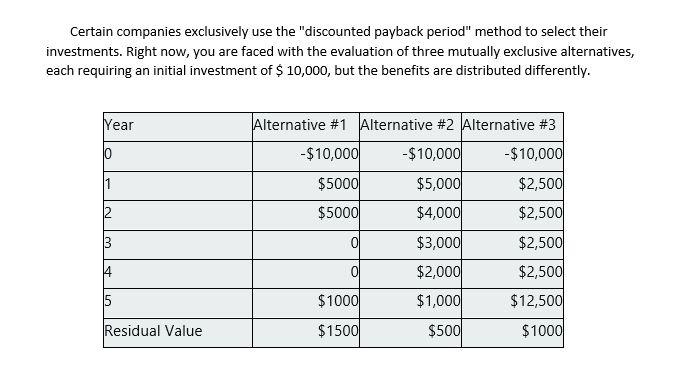

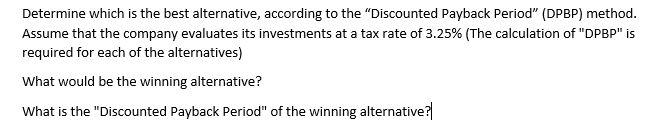

Certain companies exclusively use the "discounted payback period" method to select their investments. Right now, you are faced with the evaluation of three mutually exclusive alternatives, each requiring an initial investment of $ 10,000, but the benefits are distributed differently. Year 0 1 12 Alternative #1 Alternative #2 Alternative #3 -$10,000 -$10,000 -$10,000 $5000 $5,000 $2,500 $5000 $4,000 $2,500 0 $3,000 $2,500 $2,000 $2,500 $1000 $1,000 $12,500 4 5 Residual Value $1500 $500 $1000 Determine which is the best alternative, according to the "Discounted Payback Period" (DPBP) method. Assume that the company evaluates its investments at a tax rate of 3.25% (The calculation of "DPBP" is required for each of the alternatives) What would be the winning alternative? What is the "Discounted Payback Period" of the winning alternative? Use the Present Value method to select the best alternative What is the winning alternative using this method? What is the present value of the winning alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts