Question: Please show all steps and double check your work! Question 10 1 pts Consider the following spot interest rates for maturities of one, two, three,

Please show all steps and double check your work!

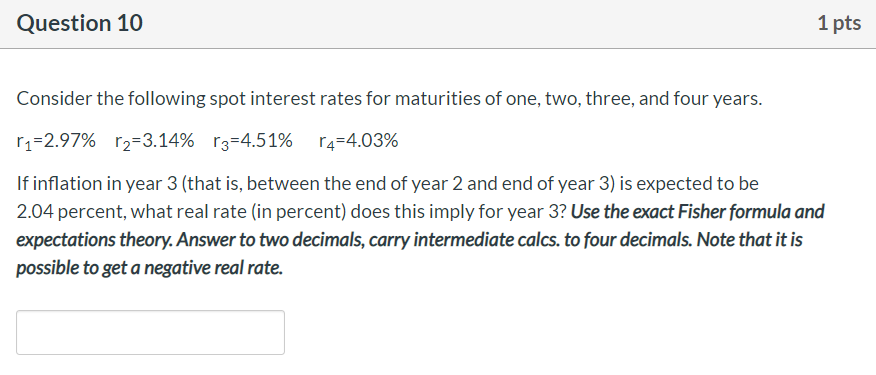

Question 10 1 pts Consider the following spot interest rates for maturities of one, two, three, and four years. r1=2.97% r2=3.14% 13=4.51% 64=4.03% If inflation in year 3 (that is, between the end of year 2 and end of year 3) is expected to be 2.04 percent, what real rate (in percent) does this imply for year 3? Use the exact Fisher formula and expectations theory. Answer to two decimals, carry intermediate calcs. to four decimals. Note that it is possible to get a negative real rate. Question 10 1 pts Consider the following spot interest rates for maturities of one, two, three, and four years. r1=2.97% r2=3.14% 13=4.51% 64=4.03% If inflation in year 3 (that is, between the end of year 2 and end of year 3) is expected to be 2.04 percent, what real rate (in percent) does this imply for year 3? Use the exact Fisher formula and expectations theory. Answer to two decimals, carry intermediate calcs. to four decimals. Note that it is possible to get a negative real rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts