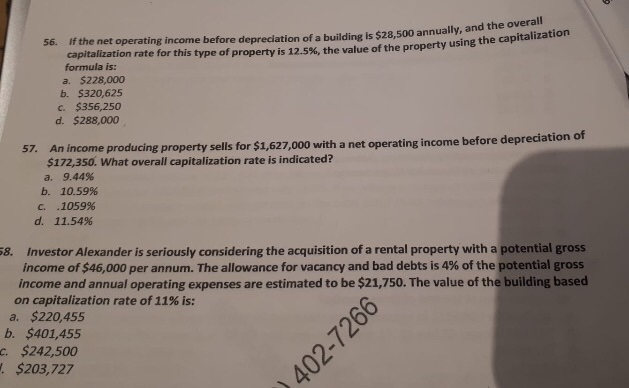

Question: Please show all steps and final answer choice for each question. Thank you! ll the net operating income before depreciation of a building is $28,500

ll the net operating income before depreciation of a building is $28,500 annually, and the overa 56. If 12.5%, the value of the property using the capitalization capitalization rate for this type of property is formula is: a. $228,000 b. $320,625 c. $356,250 d. $288,000 a net operating income before depreciation of An income producing property sells for $1,627,000 with $172,350. What overall capitalization rate is indicated? a. 9.44% 57. b. 10.59% .1059% 11.54% c, d. Investor Alexander is seriously considering the acquisition of a rental property with a potential gross 8. income of$46,000 per annum. The allowance for vacancy and bad debts is 4% of the potential gross income and annual operating expenses are estimated to be $21,750. The value of the building based on capitalization rate of 11% is: a. $220,455 b. $401,455 c. $242,500 $203,727 bt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts