Question: Please show all steps and formulas Question 2: The Oman National Grid Company ventures to a new project in the southern part of the Sultanate

Please show all steps and formulas

Please show all steps and formulas

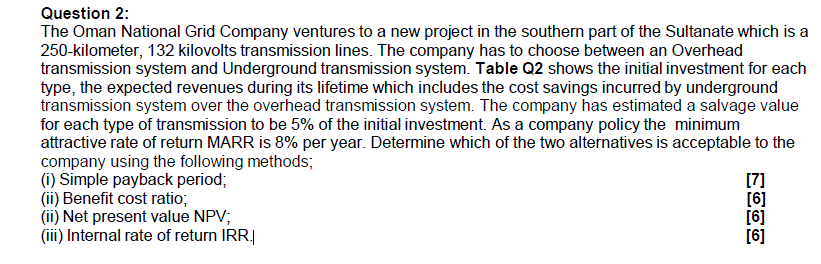

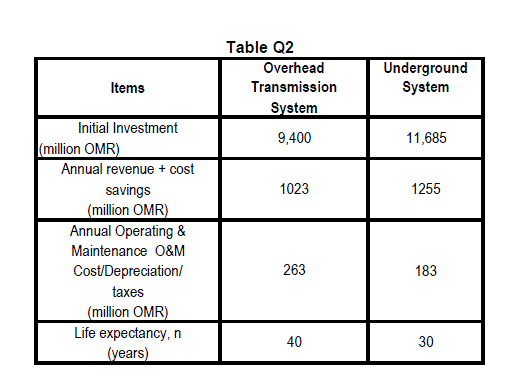

Question 2: The Oman National Grid Company ventures to a new project in the southern part of the Sultanate which is a 250-kilometer, 132 kilovolts transmission lines. The company has to choose between an Overhead transmission system and Underground transmission system. Table Q2 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company policy the minimum attractive rate of return MARR is 8% per year. Determine which of the two alternatives is acceptable to the company using the following methods; (1) Simple payback period; [7] (ii) Benefit cost ratio, [6] (ii) Net present value NPV; [6] (iii) Internal rate of return IRR. [6] Table Q2 Overhead Transmission System Underground System Items 9,400 11,685 1023 1255 Initial Investment (million OMR) Annual revenue + cost savings (million OMR) Annual Operating & Maintenance O&M Cost/Depreciation/ taxes (million OMR) Life expectancy, n (years) 263 183 40 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts