Question: Please show all steps and working Exercise 3 You came up with a new investment idea! You want to produce toys for creative kids. You

Please show all steps and working

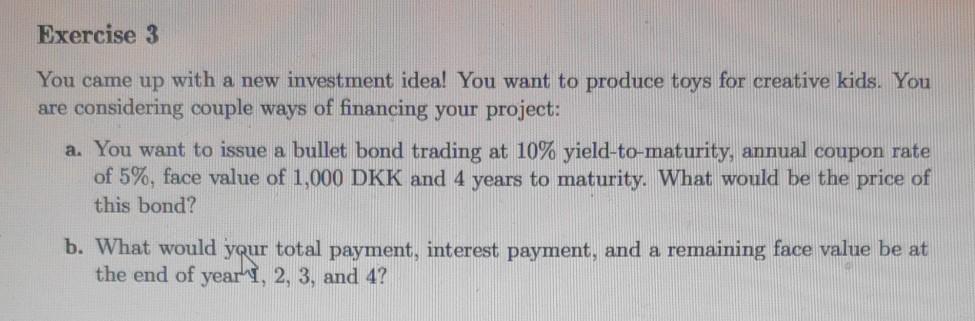

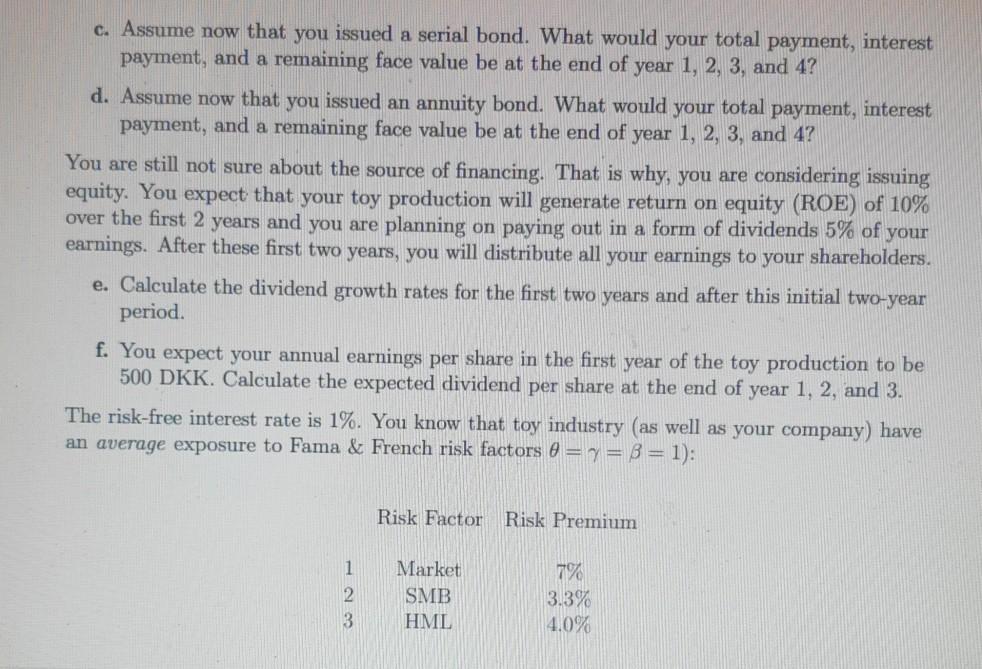

Exercise 3 You came up with a new investment idea! You want to produce toys for creative kids. You are considering couple ways of financing your project: a. You want to issue a bullet bond trading at 10% yield-to-maturity, annual coupon rate of 5%, face value of 1,000 DKK and 4 years to maturity. What would be the price of this bond? b. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? c. Assume now that you issued a serial bond. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? d. Assume now that you issued an annuity bond. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? You are still not sure about the source of financing. That is why, you are considering issuing equity. You expect that your toy production will generate return on equity (ROE) of 10% over the first 2 years and you are planning on paying out in a form of dividends 5% of your earnings. After these first two years, you will distribute all your earnings to your shareholders. e. Calculate the dividend growth rates for the first two years and after this initial two-year period. f. You expect your annual earnings per share in the first year of the toy production to be 500 DKK. Calculate the expected dividend per share at the end of year 1, 2, and 3. The risk-free interest rate is 1%. You know that toy industry (as well as your company) have an average exposure to Fama & French risk factors 8 =y=8= 1): Risk Factor Risk Premium 1 2 3 Market SMB HML 7% 3.3% 4.0% Exercise 3 You came up with a new investment idea! You want to produce toys for creative kids. You are considering couple ways of financing your project: a. You want to issue a bullet bond trading at 10% yield-to-maturity, annual coupon rate of 5%, face value of 1,000 DKK and 4 years to maturity. What would be the price of this bond? b. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? c. Assume now that you issued a serial bond. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? d. Assume now that you issued an annuity bond. What would your total payment, interest payment, and a remaining face value be at the end of year 1, 2, 3, and 4? You are still not sure about the source of financing. That is why, you are considering issuing equity. You expect that your toy production will generate return on equity (ROE) of 10% over the first 2 years and you are planning on paying out in a form of dividends 5% of your earnings. After these first two years, you will distribute all your earnings to your shareholders. e. Calculate the dividend growth rates for the first two years and after this initial two-year period. f. You expect your annual earnings per share in the first year of the toy production to be 500 DKK. Calculate the expected dividend per share at the end of year 1, 2, and 3. The risk-free interest rate is 1%. You know that toy industry (as well as your company) have an average exposure to Fama & French risk factors 8 =y=8= 1): Risk Factor Risk Premium 1 2 3 Market SMB HML 7% 3.3% 4.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts