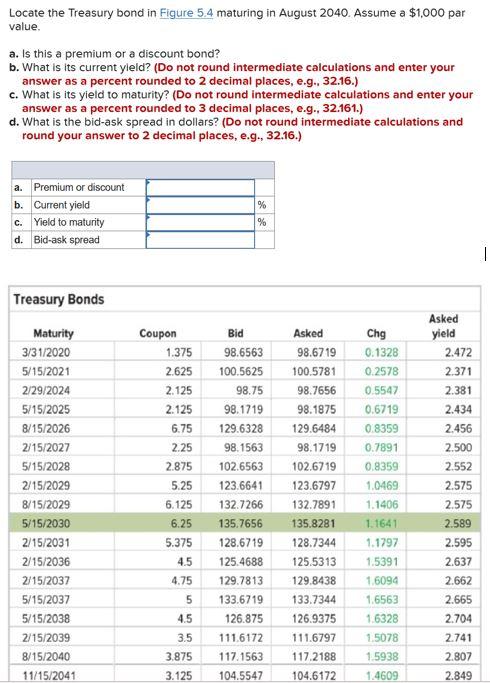

Question: Please show all steps are formulas used. Preferably in excel format. Locate the Treasury bond in Figure 5.4 maturing in August 2040. Assume a $1,000

Please show all steps are formulas used. Preferably in excel format.

Please show all steps are formulas used. Preferably in excel format.

Locate the Treasury bond in Figure 5.4 maturing in August 2040. Assume a $1,000 par value. a. Is this a premium or a discount bond? b. What is its current yleld? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) c. What is its yield to maturity? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) d. What is the bid-ask spread in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Premium or discount b. Current yield c. Yield to maturity d. Bid-ask spread % % 1 Treasury Bonds Coupon 1.375 2.625 2.125 2.125 Asked 98.6719 100.5781 98.7656 98.1875 Chg 0.1328 0.2578 0.5547 0.6719 6.75 129.6484 0.8359 2.25 Maturity 3/31/2020 5/15/2021 2/29/2024 5/15/2025 8/15/2026 2/15/2027 5/15/2028 2/15/2029 8/15/2029 5/15/2030 2/15/2031 2/15/2036 2/15/2037 5/15/2037 5/15/2038 2/15/2039 8/15/2040 11/15/2041 Bid 98.6563 100.5625 98.75 98.1719 129.6328 98.1563 102.6563 123.6641 132.7266 135.7656 128.6719 125.4688 129.7813 133.6719 126.875 111.6172 117.1563 104.5547 2.875 5.25 6.125 6.25 5.375 4.5 4.75 5 98.1719 102.6719 123.6797 132.7891 135.8281 128.7344 125.5313 129.8438 133.7344 126.9375 111.6797 117.2188 104.6172 Asked yield 2.472 2.371 2.381 2.434 2.456 2.500 2.552 2.575 2.575 2.589 2.595 2.637 2.662 2.665 0.7891 0.8359 1.0469 1.1406 1.1641 1.1797 1.5391 1.6094 1.6563 1.6328 4.5 2.704 3.5 3.875 1.5078 1.5938 1.4609 2.741 2.807 2.849 3.125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts