Question: Please show all steps Exercise 2 Consider a market where a number of zero-coupon bonds with a face value of 1000 are traded. The zero-coupon

Please show all steps

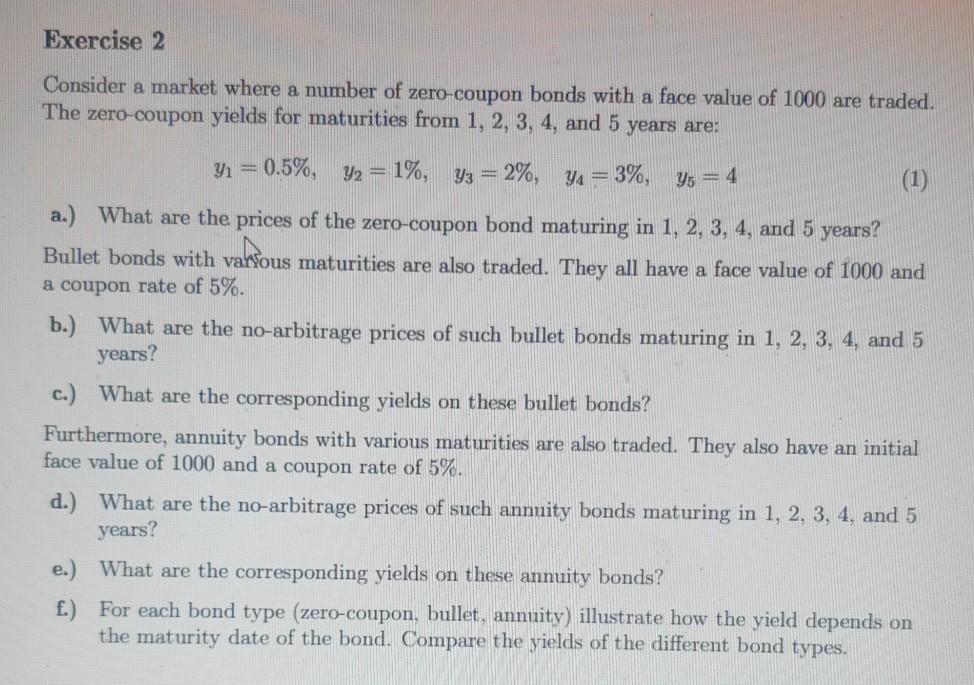

Exercise 2 Consider a market where a number of zero-coupon bonds with a face value of 1000 are traded. The zero-coupon yields for maturities from 1, 2, 3, 4, and 5 years are: Ys = 4 y = 0.5%, y2 = 1%, y3 = 2%, YA = 3%, a.) What are the prices of the zero-coupon bond maturing in 1, 2, 3, 4, and 5 years? Bullet bonds with varfous maturities are also traded. They all have a face value of 1000 and valou a coupon rate of 5%. b.) What are the no-arbitrage prices of such bullet bonds maturing in 1, 2, 3, 4, and 5 years? c.) What are the corresponding yields on these bullet bonds? Furthermore, annuity bonds with various maturities are also traded. They also have an initial face value of 1000 and a coupon rate of 5%. d.) What are the no-arbitrage prices of such annuity bonds maturing in 1, 2, 3, 4, and 5 years? e.) What are the corresponding yields on these anmity bonds? f.) For each bond type (zero-coupon, bullet, annuity) illustrate how the yield depends on the maturity date of the bond. Compare the yields of the different bond types

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts