Question: Please show all steps Exercise 4 Assume that the assumptions of the constant dividend growth model hold and that company Xyz has earnings per share

Please show all steps

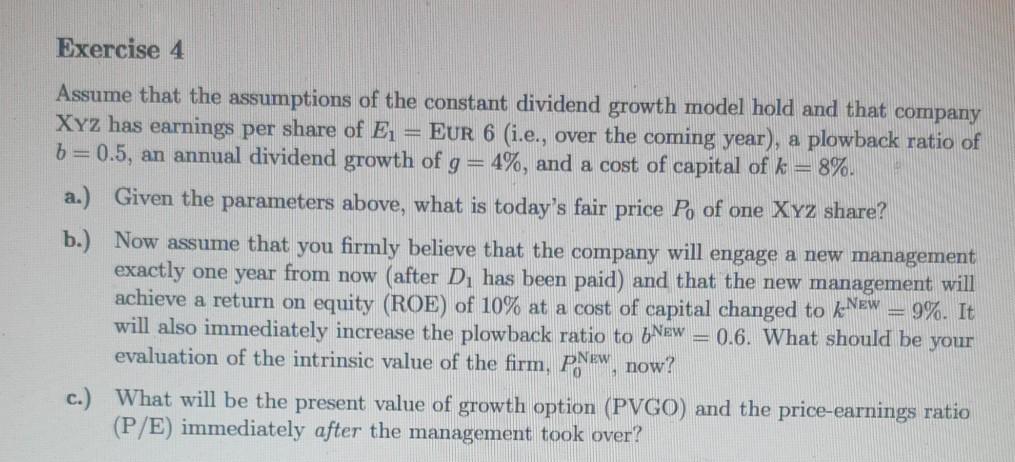

Exercise 4 Assume that the assumptions of the constant dividend growth model hold and that company Xyz has earnings per share of E1 = EUR 6 (i.e., over the coming year), a plowback ratio of b=0.5, an annual dividend growth of g = 4%, and a cost of capital of k = 8%. a.) Given the parameters above, what is today's fair price Po of one Xyz share? b.) Now assume that you firmly believe that the company will engage a new management exactly one year from now (after D, has been paid) and that the new management will achieve a return on equity (ROE) of 10% at a cost of capital changed to kNew = 9%. It will also immediately increase the plowback ratio to bNew = 0.6. What should be your evaluation of the intrinsic value of the firm, PNew, now? c.) What will be the present value of growth option (PVGO) and the price-earnings ratio (P/E) immediately after the management took over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts