Question: please show all steps for thump up no excel please compare AW not PW this is what i did but my professsor mark it wrong

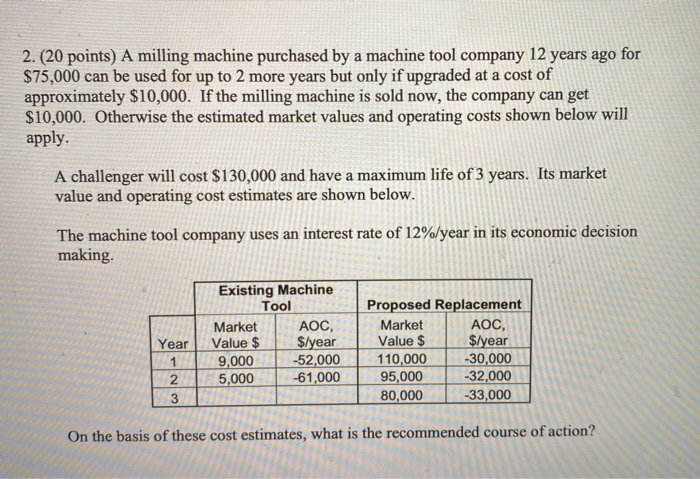

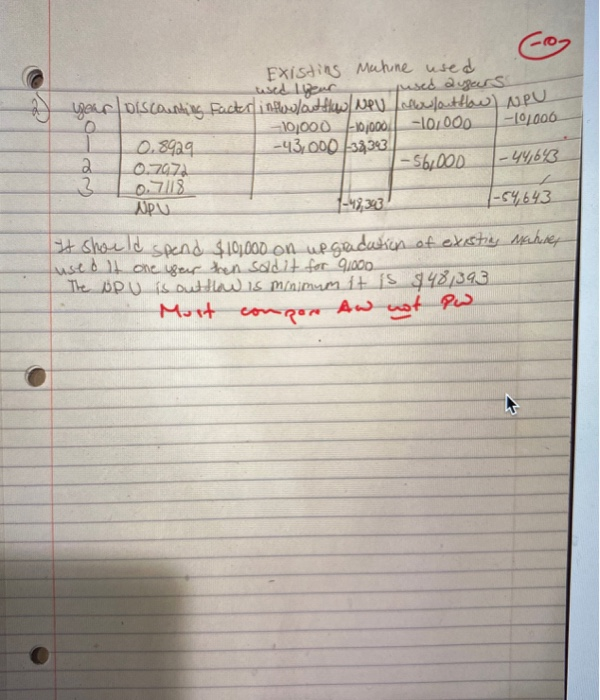

2. (20 points) A milling machine purchased by a machine tool company 12 years ago for $75,000 can be used for up to 2 more years but only if upgraded at a cost of approximately $10,000. If the milling machine is sold now, the company can get $10,000. Otherwise the estimated market values and operating costs shown below will apply. A challenger will cost $130,000 and have a maximum life of 3 years. Its market value and operating cost estimates are shown below. The machine tool company uses an interest rate of 12%/year in its economic decision making. Existing Machine Tool Market AOC, Value $ $/year 9,000 -52,000 5,000 -61,000 Year Proposed Replacement Market AOC, Value $ $/year 110,000 -30,000 95,000 -32,000 80,000 -33,000 1 2 3 On the basis of these cost estimates, what is the recommended course of action? Existing Machine used wad Iyeur jused augers year Discounting facter inflow/out flow/ Newsler/outdow) NPU 0 |--101000 10000 -10,000 -192000 0.8929 -43,000 -38343 a 0.7070 - 56,000 1-44,66 3 0.7/18 1-54,643 It should spend $10,000 on upgradation of existing machines used it one year then sold it for 91000. The UPU is out how is minimum it is $481393 Most conpon Aw not po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts