Question: please show all steps. Thank you Problem 1, Consider a plant costing $L,000,000 to build that produces a product A. For the same capital outlay

please show all steps. Thank you

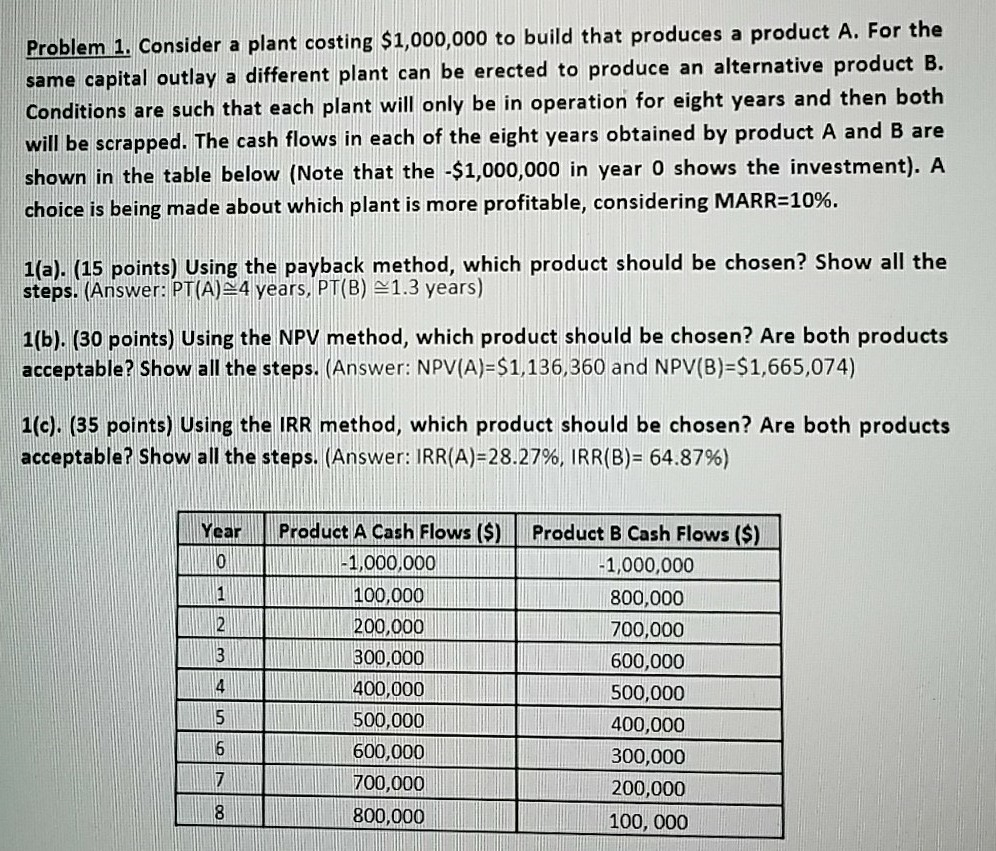

Problem 1, Consider a plant costing $L,000,000 to build that produces a product A. For the same capital outlay a different plant can be erected to produce an alternative product B. Conditions are such that each plant will only be in operation for eight years and then both will be scrapped. The cash flows in each of the eight years obtained by product A and B are shown in the table below (Note that the -$1,000,000 in year 0 shows the investment). A choice is being made about which plant is more profitable, considering MARR-1096. 1(a). (15 points) Using the payback method, which product should be chosen? Show all the steps. (Answer: PT(A) 4 years, PT(B) 1.3 years) 1(b). (30 points) Using the NPV method, which product should be chosen? Are both products acceptable? Show all the steps. (Answer: NPV(A)-$1,136,360 and NPV(B)-$1,665,074) 1(c). (35 points) Using the IRR method, which product should be chosen? Are both products acceptable? show all the steps. (Answer: IRRIA)-28.27%, IRR(B)-64.87%) Year Product A Cash Flows (SProduct B Cash Flows () o1,000,0oo 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 1,000,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100, 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts