Question: PLEASE SHOW ALL STEPS, THANKS Question 2 - 2 marks You have the following data on call prices covering the same asset with the same

PLEASE SHOW ALL STEPS, THANKS

PLEASE SHOW ALL STEPS, THANKS

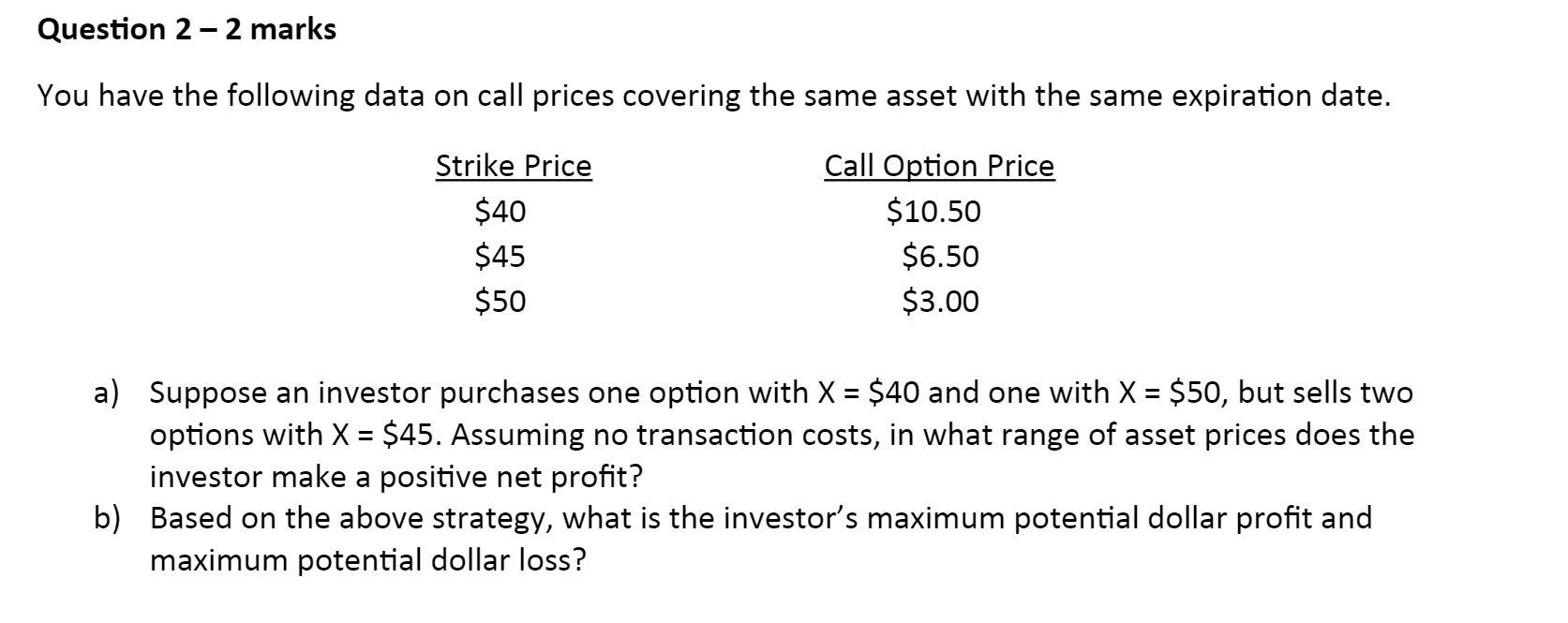

Question 2 - 2 marks You have the following data on call prices covering the same asset with the same expiration date. Strike Price $40 $45 $50 Call Option Price $10.50 $6.50 $3.00 a) Suppose an investor purchases one option with X = $40 and one with X = $50, but sells two options with X = $45. Assuming no transaction costs, in what range of asset prices does the investor make a positive net profit? b) Based on the above strategy, what is the investor's maximum potential dollar profit and maximum potential dollar loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts