Question: please show all steps with formulas and explanations 2. Consider an expected utility maximizing risk-averse individual with the utility-ofwealth function u(w) and initial wealth w0.

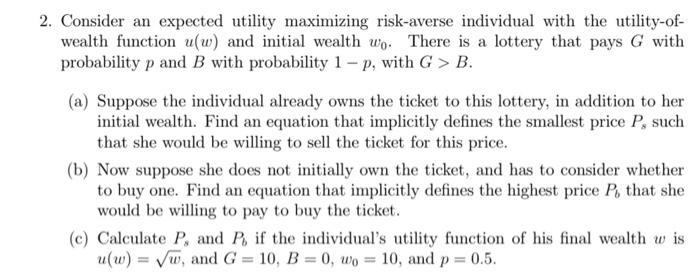

2. Consider an expected utility maximizing risk-averse individual with the utility-ofwealth function u(w) and initial wealth w0. There is a lottery that pays G with probability p and B with probability 1p, with G>B. (a) Suppose the individual already owns the ticket to this lottery, in addition to her initial wealth. Find an equation that implicitly defines the smallest price Ps such that she would be willing to sell the ticket for this price. (b) Now suppose she does not initially own the ticket, and has to consider whether to buy one. Find an equation that implicitly defines the highest price Pb that she would be willing to pay to buy the ticket. (c) Calculate Ps and Pb if the individual's utility function of his final wealth w is u(w)=w, and G=10,B=0,w0=10, and p=0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts