Question: please show all the calculation and formula used. (a) Paul want to set up an investment portfolio based on two stocks, Alibaba and Tesia. Alibaba

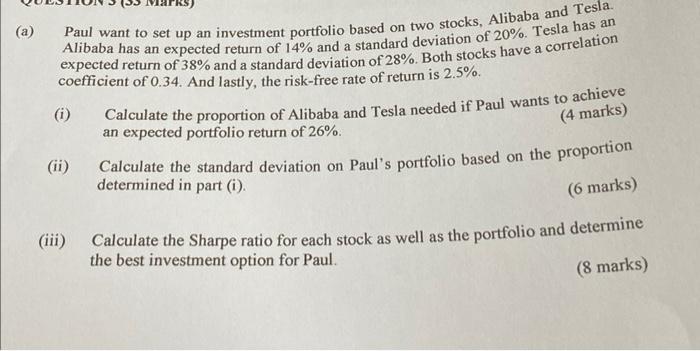

(a) Paul want to set up an investment portfolio based on two stocks, Alibaba and Tesia. Alibaba has an expected return of 14% and a standard deviation of 20%. Tesla has an expected return of 38% and a standard deviation of 28%. Both stocks have a correlation coefficient of 0.34. And lastly, the risk-free rate of return is 2.5%. (i) Calculate the proportion of Alibaba and Tesla needed if Paul wants to achieve an expected portfolio return of 26%. (4 marks) (ii) Calculate the standard deviation on Paul's portfolio based on the proportion determined in part (i). (6 marks) (iii) Calculate the Sharpe ratio for each stock as well as the portfolio and determine the best investment option for Paul. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts