Question: please show all the steps. 2) This question deals with nominal and real interest rates before and after taxation. Assume the following: i. Investor #

please show all the steps.

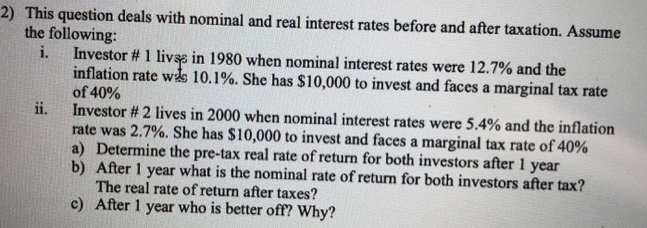

2) This question deals with nominal and real interest rates before and after taxation. Assume the following: i. Investor # 1 livse in 1980 when nominal interest rates were 12.7% and the inflation rate wils 10.1%. She has $10,000 to invest and faces a marginal tax rate of 40% Investor # 2 lives in 2000 when nominal interest rates were 5.4% and the inflation rate was 2.7%. She has $10,000 to invest and faces a marginal tax rate of 40% a) Determine the pre-tax real rate of return for both investors after 1 year b) After 1 year what is the nominal rate of return for both investors after tax? The real rate of return after taxes? c) After 1 year who is better off? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts