Question: Please show all the steps and inputs to solve this using excel *** USE THE WORK OF PART B TO SOLVE FOR PART D ***

Please show all the steps and inputs to solve this using excel

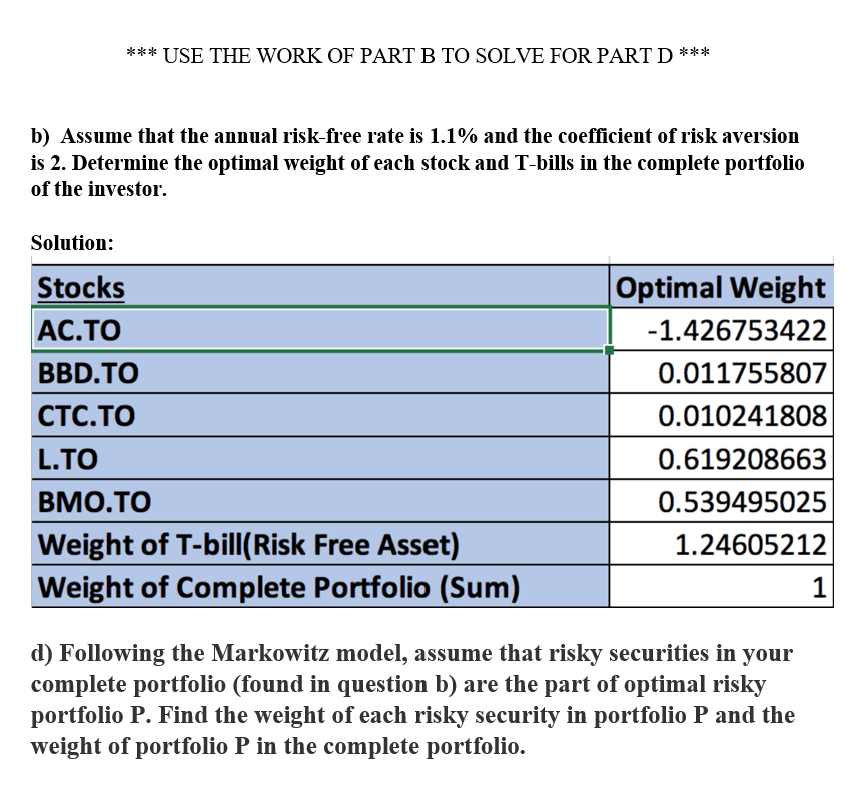

*** USE THE WORK OF PART B TO SOLVE FOR PART D *** b) Assume that the annual risk-free rate is 1.1% and the coefficient of risk aversion is 2. Determine the optimal weight of each stock and T-bills in the complete portfolio of the investor. Solution: Stocks AC.TO BBD.TO CTC. TO L.TO BMO.TO Weight of T-bill(Risk Free Asset) Weight of Complete Portfolio (Sum) Optimal Weight -1.426753422 0.011755807 0.010241808 0.619208663 0.539495025 1.24605212 1 d) Following the Markowitz model, assume that risky securities in your complete portfolio (found in question b) are the part of optimal risky portfolio P. Find the weight of each risky security in portfolio P and the weight of portfolio P in the complete portfolio. *** USE THE WORK OF PART B TO SOLVE FOR PART D *** b) Assume that the annual risk-free rate is 1.1% and the coefficient of risk aversion is 2. Determine the optimal weight of each stock and T-bills in the complete portfolio of the investor. Solution: Stocks AC.TO BBD.TO CTC. TO L.TO BMO.TO Weight of T-bill(Risk Free Asset) Weight of Complete Portfolio (Sum) Optimal Weight -1.426753422 0.011755807 0.010241808 0.619208663 0.539495025 1.24605212 1 d) Following the Markowitz model, assume that risky securities in your complete portfolio (found in question b) are the part of optimal risky portfolio P. Find the weight of each risky security in portfolio P and the weight of portfolio P in the complete portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts