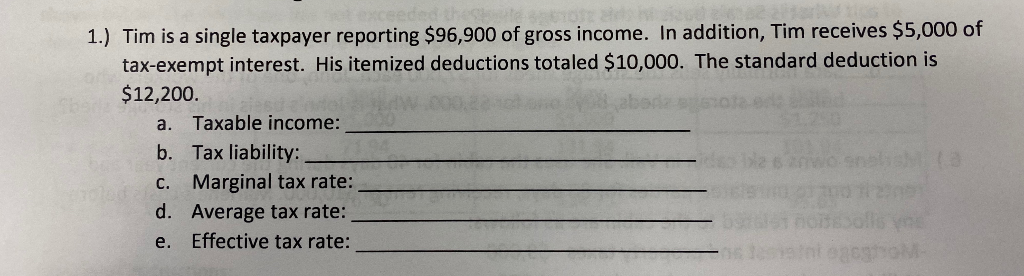

Question: Please show all the work 1.) Tim is a single taxpayer reporting $96,900 of gross income. In addition, Tim receives $5,000 of tax-exempt interest. His

Please show all the work

Please show all the work

1.) Tim is a single taxpayer reporting $96,900 of gross income. In addition, Tim receives $5,000 of tax-exempt interest. His itemized deductions totaled $10,000. The standard deduction is $12,200. a. Taxable income: b. Tax liability: - C. Marginal tax rate: d. Average tax rate: F ools e. Effective tax rate: - into

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts