Question: PLEASE SHOW ALL THE WORK Question 4 Susan, a single taxpayer, owns and operates a bakery as a sole proprietorship. The business is not a

PLEASE SHOW ALL THE WORK

PLEASE SHOW ALL THE WORK

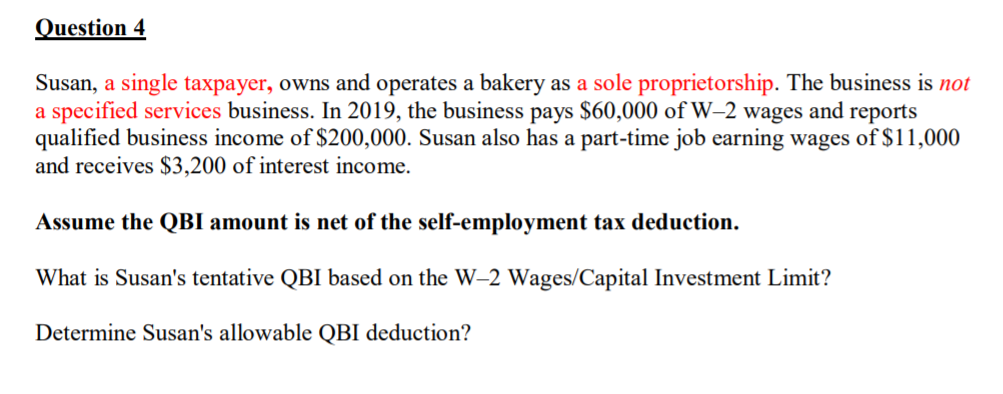

Question 4 Susan, a single taxpayer, owns and operates a bakery as a sole proprietorship. The business is not a specified services business. In 2019, the business pays $60,000 of W-2 wages and reports qualified business income of $200,000. Susan also has a part-time job earning wages of $11,000 and receives $3,200 of interest income. Assume the QBI amount is net of the self-employment tax deduction. What is Susan's tentative QBI based on the W2 Wages/Capital Investment Limit? Determine Susan's allowable QBI deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts