Question: please show all the work without using excelthanks Lebron Jason Inc. just paid a dividend (D0) of $3.00/ share. The firm's dividend payment is expected

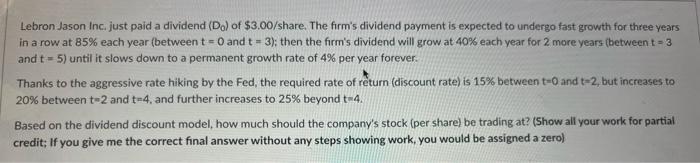

Lebron Jason Inc. just paid a dividend (D0) of $3.00/ share. The firm's dividend payment is expected to undergo fast growth for three years in a row at 85% each year (between t=0 and t=3 ); then the firm's dividend will grow at 40% each year for 2 more years (between t=3 and t=5 ) until it slows down to a permanent growth rate of 4% per year forever. Thanks to the aggressive rate hiking by the Fed, the required rate of return (discount rate) is 15% between t=0 and t=2, but increases to 20% between t=2 and t=4, and further increases to 25% beyond t=4. Based on the dividend discount model, how much should the company's stock (per share) be trading at? (Show all your work for partial credit; If you give me the correct final answer without any steps showing work, you would be assigned a zero)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts