Question: please show all work 1. AAA Shop is considering a project to improve their production efficiency. They are trying to decide whether it is a

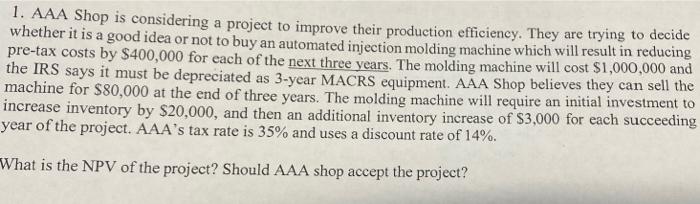

1. AAA Shop is considering a project to improve their production efficiency. They are trying to decide whether it is a good idea or not to buy an automated injection molding machine which will result in reducing pre-tax costs by $400,000 for each of the next three years. The molding machine will cost $1,000,000 and the IRS says it must be depreciated as 3-year MACRS equipment. AAA Shop believes they can sell the machine for $80,000 at the end of three years. The molding machine will require an initial investment to increase inventory by $20,000, and then an additional inventory increase of $3,000 for each succeeding year of the project. AAA's tax rate is 35% and uses a discount rate of 14%. What is the NPV of the project? Should AAA shop accept the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts