Question: please show all work 2. (4 pts) A 3-month put option on a stock is priced at $6.10. The theta for this put is 9.85.

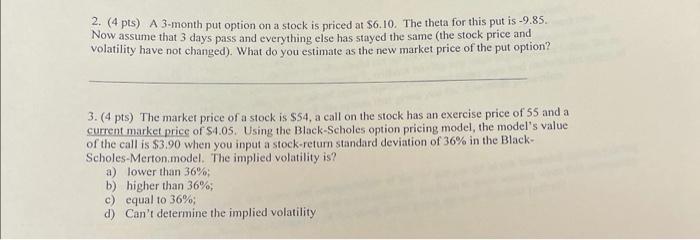

2. (4 pts) A 3-month put option on a stock is priced at $6.10. The theta for this put is 9.85. Now assume that 3 days pass and everything else has stayed the same (the stock price and volatility have not changed). What do you estimate as the new market price of the put option? 3. (4 pts) The market price of a stock is $54, a call on the stock has an exercise price of 55 and a current market price of $4.05. Using the Black-Scholes option pricing model, the model's value of the call is $3.90 when you input a stock-return standard deviation of 36% in the Black- Scholes-Merton.model. The implied volatility is? a) lower than 36%; b) higher than 36%; c) equal to 36%; d) Can't determine the implied volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts