Question: please show all work 5. (6 Points) You work for company QAZ and your work is to estimate the cost of capital for a new

please show all work

please show all work

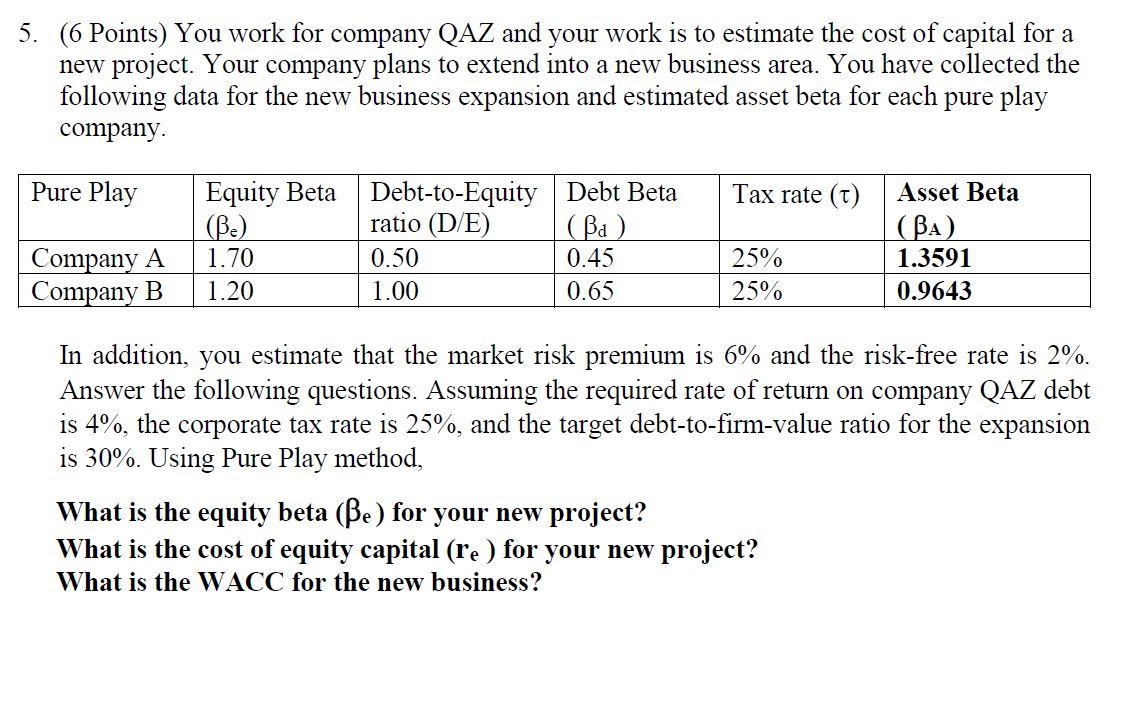

5. (6 Points) You work for company QAZ and your work is to estimate the cost of capital for a new project. Your company plans to extend into a new business area. You have collected the following data for the new business expansion and estimated asset beta for each pure play company Pure Play Tax rate (1) Equity Beta (Be) 1.70 1.20 Debt-to-Equity Debt Beta ratio (DE) (Ba) 0.50 0.45 1.00 0.65 Asset Beta (BA) 1.3591 0.9643 Company A Company B 25% 25% In addition, you estimate that the market risk premium is 6% and the risk-free rate is 2%. Answer the following questions. Assuming the required rate of return on company QAZ debt is 4%, the corporate tax rate is 25%, and the target debt-to-firm-value ratio for the expansion is 30%. Using Pure Play method, What is the equity beta (e) for your new project? What is the cost of equity capital (re ) for your new project? What is the WACC for the new business? 5. (6 Points) You work for company QAZ and your work is to estimate the cost of capital for a new project. Your company plans to extend into a new business area. You have collected the following data for the new business expansion and estimated asset beta for each pure play company Pure Play Tax rate (1) Equity Beta (Be) 1.70 1.20 Debt-to-Equity Debt Beta ratio (DE) (Ba) 0.50 0.45 1.00 0.65 Asset Beta (BA) 1.3591 0.9643 Company A Company B 25% 25% In addition, you estimate that the market risk premium is 6% and the risk-free rate is 2%. Answer the following questions. Assuming the required rate of return on company QAZ debt is 4%, the corporate tax rate is 25%, and the target debt-to-firm-value ratio for the expansion is 30%. Using Pure Play method, What is the equity beta (e) for your new project? What is the cost of equity capital (re ) for your new project? What is the WACC for the new business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts