Question: Please show all work (8 points) Louis is evaluating an investment. They will pay X right now and 1.3X in one year. In exchange, they

Please  show all work

show all work

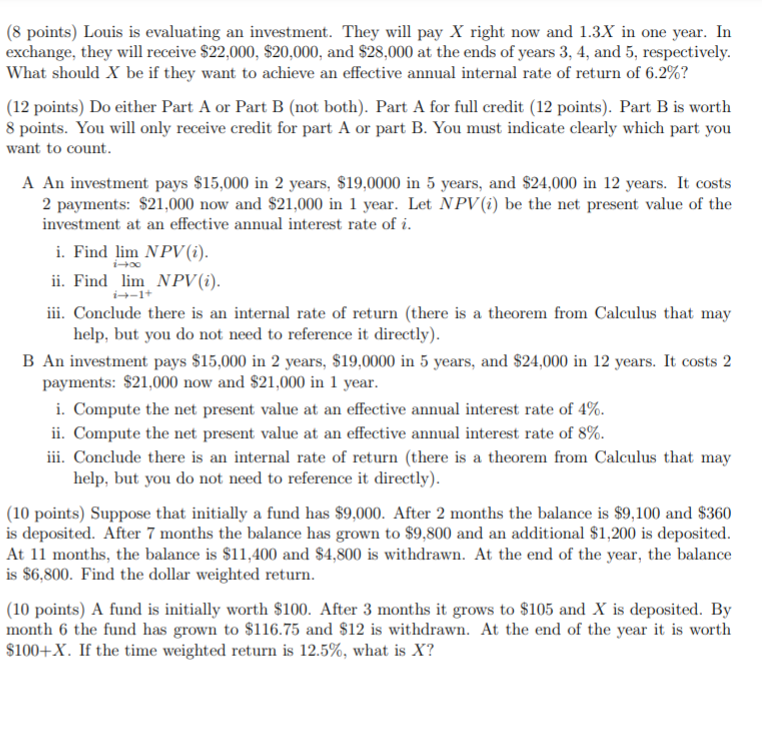

(8 points) Louis is evaluating an investment. They will pay X right now and 1.3X in one year. In exchange, they will receive $22,000, $20,000, and $28,000 at the ends of years 3, 4, and 5, respectively. What should X be if they want to achieve an effective annual internal rate of return of 6.2%? (12 points) Do either Part A or Part B (not both). Part A for full credit (12 points). Part B is worth 8 points. You will only receive credit for part A or part B. You must indicate clearly which part you want to count. A An investment pays $15,000 in 2 years, $19,0000 in 5 years, and $24,000 in 12 years. It costs 2 payments: $21,000 now and $21,000 in 1 year. Let NPV(i) be the net present value of the investment at an effective annual interest rate of i. i. Find lim NPV(i). ii. Find lim NPV(i). iii. Conclude there is an internal rate of return (there is a theorem from Calculus that may help, but you do not need to reference it directly). B An investment pays $15,000 in 2 years, $19,0000 in 5 years, and $24,000 in 12 years. It costs 2 payments: $21,000 now and $21,000 in 1 year. i. Compute the net present value at an effective annual interest rate of 4%. ii. Compute the net present value at an effective annual interest rate of 8%. iii. Conclude there is an internal rate of return (there is a theorem from Calculus that may help, but you do not need to reference it directly). (10 points) Suppose that initially a fund has $9,000. After 2 months the balance is $9,100 and $360 is deposited. After 7 months the balance has grown to $9,800 and an additional $1,200 is deposited. At 11 months, the balance is $11,400 and $4,800 is withdrawn. At the end of the year, the balance is $6,800. Find the dollar weighted return. (10 points) A fund is initially worth $100. After 3 months it grows to $105 and X is deposited. By month 6 the fund has grown to $116.75 and $12 is withdrawn. At the end of the year it is worth $100+X. If the time weighted return is 12.5%, what is X? (8 points) Louis is evaluating an investment. They will pay X right now and 1.3X in one year. In exchange, they will receive $22,000, $20,000, and $28,000 at the ends of years 3, 4, and 5, respectively. What should X be if they want to achieve an effective annual internal rate of return of 6.2%? (12 points) Do either Part A or Part B (not both). Part A for full credit (12 points). Part B is worth 8 points. You will only receive credit for part A or part B. You must indicate clearly which part you want to count. A An investment pays $15,000 in 2 years, $19,0000 in 5 years, and $24,000 in 12 years. It costs 2 payments: $21,000 now and $21,000 in 1 year. Let NPV(i) be the net present value of the investment at an effective annual interest rate of i. i. Find lim NPV(i). ii. Find lim NPV(i). iii. Conclude there is an internal rate of return (there is a theorem from Calculus that may help, but you do not need to reference it directly). B An investment pays $15,000 in 2 years, $19,0000 in 5 years, and $24,000 in 12 years. It costs 2 payments: $21,000 now and $21,000 in 1 year. i. Compute the net present value at an effective annual interest rate of 4%. ii. Compute the net present value at an effective annual interest rate of 8%. iii. Conclude there is an internal rate of return (there is a theorem from Calculus that may help, but you do not need to reference it directly). (10 points) Suppose that initially a fund has $9,000. After 2 months the balance is $9,100 and $360 is deposited. After 7 months the balance has grown to $9,800 and an additional $1,200 is deposited. At 11 months, the balance is $11,400 and $4,800 is withdrawn. At the end of the year, the balance is $6,800. Find the dollar weighted return. (10 points) A fund is initially worth $100. After 3 months it grows to $105 and X is deposited. By month 6 the fund has grown to $116.75 and $12 is withdrawn. At the end of the year it is worth $100+X. If the time weighted return is 12.5%, what is X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts