Question: PLEASE SHOW ALL WORK A Food processing plant just purchased a new equipment to read 96-bit product codes with the B of $52,000 and a

PLEASE SHOW ALL WORK

PLEASE SHOW ALL WORK

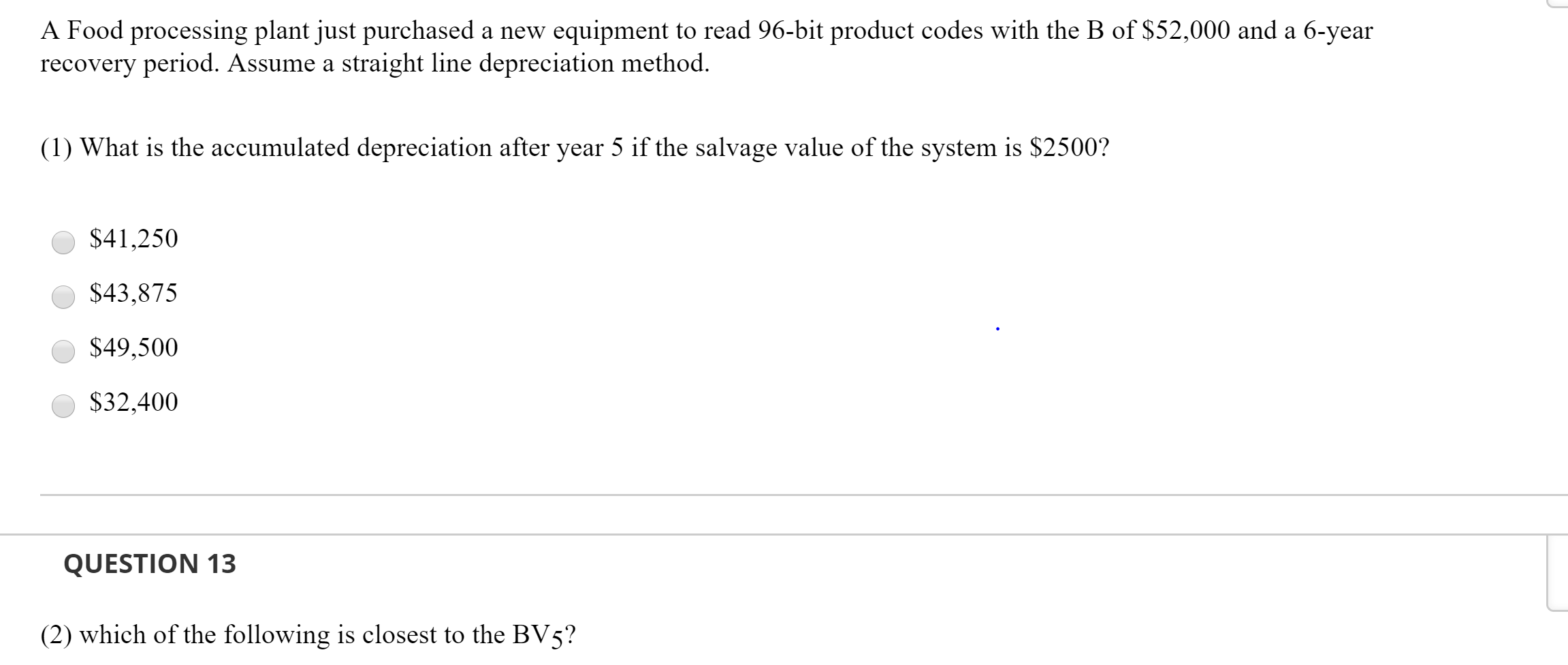

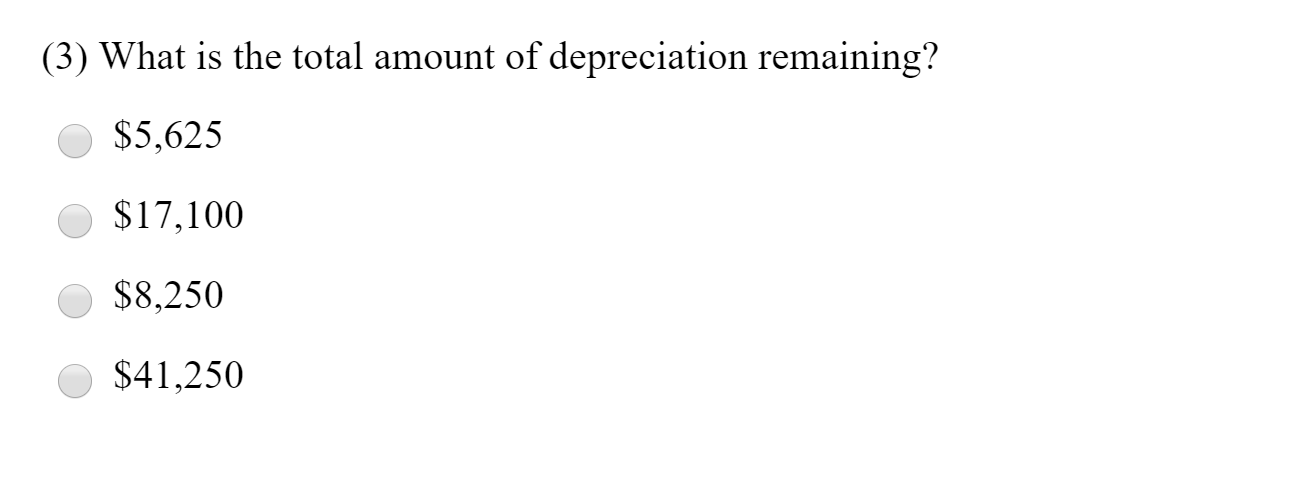

A Food processing plant just purchased a new equipment to read 96-bit product codes with the B of $52,000 and a 6-year recovery period. Assume a straight line depreciation method. (1) What is the accumulated depreciation after year 5 if the salvage value of the system is $2500? $41,250 $43,875 $49,500 $32,400 QUESTION 13 (2) which of the following is closest to the BV5? (3) What is the total amount of depreciation remaining? $5,625 $17,100 $8,250 $41,250

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock