Question: PLEASE SHOW ALL WORK Accounting for deferred costs (LO 11-2) Required: 1. What amount of costs will be capitalized as deferred contract costs upon the

PLEASE SHOW ALL WORK

PLEASE SHOW ALL WORK

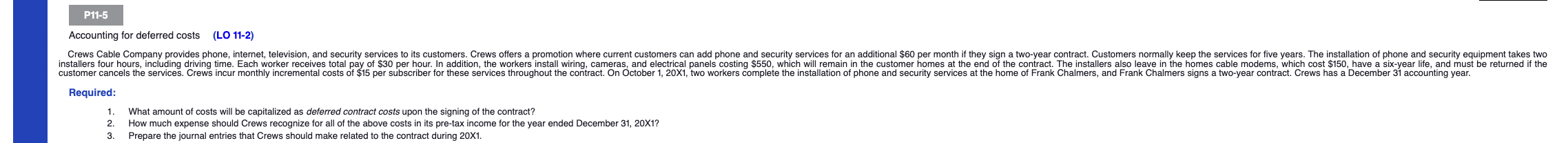

Accounting for deferred costs (LO 11-2) Required: 1. What amount of costs will be capitalized as deferred contract costs upon the signing of the contract? 2 How much expense should Crews recognize for all of the above costs in its pre-tax income for the year ended December 31,201 ? 2. How much expense should Crews recognize for all of the above costs in its pre-tax income 3. Prepare the journal entries that Crews should make related to the contract during 20X1. Accounting for deferred costs (LO 11-2) Required: 1. What amount of costs will be capitalized as deferred contract costs upon the signing of the contract? 2 How much expense should Crews recognize for all of the above costs in its pre-tax income for the year ended December 31,201 ? 2. How much expense should Crews recognize for all of the above costs in its pre-tax income 3. Prepare the journal entries that Crews should make related to the contract during 20X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts