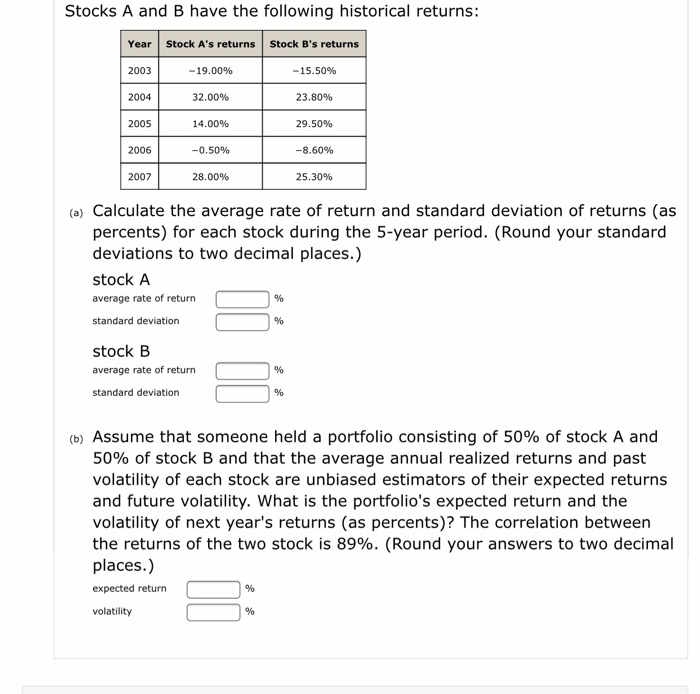

Question: Please show all work and clear steps as to how you got each solution!! Stocks A and B have the following historical returns: Year Stock

Stocks A and B have the following historical returns: Year Stock A's returns Stock B's returns 2003 -19.00% - 15.50% 2004 32.00% 23.80% 2005 14.00% 29.50% 2006 -0.50% -8.60% 2007 28.00% 25.30% (a) Calculate the average rate of return and standard deviation of returns (as percents) for each stock during the 5-year period. (Round your standard deviations to two decimal places.) stock A average rate of return standard deviation stock B average rate of return standard deviation (b) Assume that someone held a portfolio consisting of 50% of stock A and 50% of stock B and that the average annual realized returns and past volatility of each stock are unbiased estimators of their expected returns and future volatility. What is the portfolio's expected return and the volatility of next year's returns (as percents)? The correlation between the returns of the two stock is 89%. (Round your answers to two decimal places.) expected return volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts