Question: please show all work and correct answer only! 14. a. Discuss how each of the following theories for the term structure of interest rates could

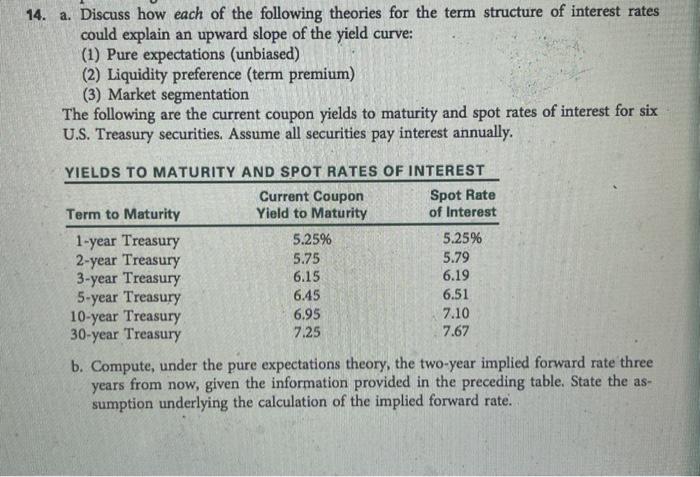

14. a. Discuss how each of the following theories for the term structure of interest rates could explain an upward slope of the yield curve: (1) Pure expectations (unbiased) (2) Liquidity preference (term premium) (3) Market segmentation The following are the current coupon yields to maturity and spot rates of interest for six U.S. Treasury securities. Assume all securities pay interest annually. YIELDS TO MATURITY AND SPOT RATES OF INTEREST Current Coupon Spot Rate Term to Maturity Yield to Maturity of Interest 1-year Treasury 5.25% 5.25% 2-year Treasury 5.75 5.79 3-year Treasury 6.15 6.19 5-year Treasury 6.45 6.51 10-year Treasury 6.95 7.10 30-year Treasury 7.25 7.67 b. Compute, under the pure expectations theory, the two-year implied forward rate three years from now, given the information provided in the preceding table. State the as- sumption underlying the calculation of the implied forward rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts