Question: please show all work and equation 1. (NOTE: You do not need a cash flow diagram for this problem) Mount Nittany Medical Center purchased an

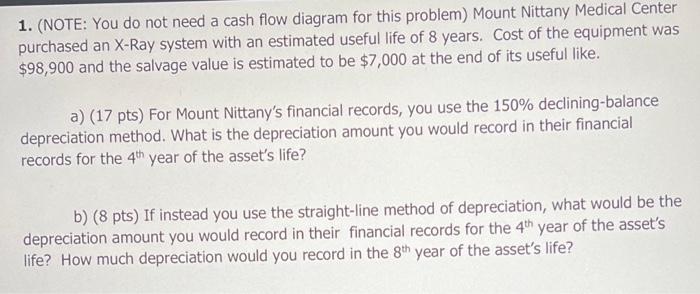

1. (NOTE: You do not need a cash flow diagram for this problem) Mount Nittany Medical Center purchased an X-Ray system with an estimated useful life of 8 years. Cost of the equipment was $98,900 and the salvage value is estimated to be $7,000 at the end of its useful like. a) (17 pts) For Mount Nittany's financial records, you use the 150% declining-balance depreciation method. What is the depreciation amount you would record in their financial records for the 4th year of the asset's life? b) ( 8 pts) If instead you use the straight-line method of depreciation, what would be the depreciation amount you would record in their financial records for the 4th year of the asset's life? How much depreciation would you record in the 8th year of the asset's life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts